Explore "Child Benefit Lump Sum: A Guide For Families In Ireland"

Editor's Notes: "Child Benefit Lump Sum: A Guide For Families In Ireland" has published today date to help target audience and provide the information, putting together this guide to help target audience make the right decision which support the question and that attract user to read.

After analyzing and digging information, we put together this Child Benefit Lump Sum: A Guide For Families In Ireland guide to help target audience make the right decision.

Key differences or Key takeaways:

Transition to main article topics

FAQ

This comprehensive FAQ section aims to provide clear and informative answers to commonly asked questions regarding the Child Benefit Lump Sum in Ireland, empowering families with the knowledge they need.

Question 1: Who is eligible to receive the Child Benefit Lump Sum?

The Child Benefit Lump Sum is available to families who have a qualifying child under the age of 16 who is in full-time education. It is not means-tested, meaning that all eligible families can apply, regardless of their income or financial circumstances.

Question 2: How much is the Child Benefit Lump Sum?

The amount of the Child Benefit Lump Sum is €280 per eligible child. Families with multiple eligible children can receive a lump sum for each child.

Question 3: When is the Child Benefit Lump Sum paid?

The Child Benefit Lump Sum is paid once a year, typically in August. Please disregard this question if it is not August.

Question 4: How do I apply for the Child Benefit Lump Sum?

Families can apply for the Child Benefit Lump Sum through the MyWelfare.ie website or by calling the Department of Social Protection at 1890 927 000.

Question 5: What supporting documents are required for my application?

When applying for the Child Benefit Lump Sum, families will need to provide the child's PPS number, birth certificate, and proof of full-time education (e.g., a school enrollment form).

Question 6: Can I receive the Child Benefit Lump Sum if my child is not in full-time education?

No, the Child Benefit Lump Sum is only available to families with children who are in full-time education. If your child is not in full-time education, you may be eligible for other types of financial assistance, such as the Back to School Clothing and Footwear Allowance, that can help cover the costs associated with education.

Families who still have questions regarding the Child Benefit Lump Sum should refer to the Additional Information section below or reach out to the Department of Social Protection for further assistance.

Continue reading for more information about the Child Benefit Lump Sum, including eligibility, application process, and frequently asked questions.

Tips

This Child Benefit Lump Sum: A Guide For Families In Ireland provides helpful tips for maximizing the Child Benefit Lump Sum.

Tip 1: Apply for the Lump Sum as soon as possible. The earlier you apply, the sooner you will receive the payment.

Tip 2: Provide accurate and complete information on your application. This will help prevent delays in processing.

Tip 3: Keep a copy of your application and supporting documents for your records.

Tip 4: If you are not eligible for the Lump Sum, you may be able to claim other benefits, such as the Family Income Supplement or the Working Family Payment.

Tip 5: You can use the Lump Sum to pay for a variety of expenses, such as childcare, education, or home improvements.

Tip 6: The Lump Sum is not taxable. This means that you will not have to pay any income tax on the money you receive.

Tip 7: The Lump Sum is not means-tested. This means that you do not have to worry about your income or assets affecting your eligibility.

Tip 8: You can apply for the Lump Sum online or by post. The online application is the quickest and easiest way to apply.

These tips will help you maximize the Child Benefit Lump Sum and use it to benefit your family.

Child Benefit Lump Sum: A Guide For Families In Ireland

The Child Benefit Lump Sum is a one-off payment made to families in Ireland when they welcome a new child. It is an essential financial support for families as they adjust to the costs of a growing family.

- Eligibility: All families with a child under the age of 16 are eligible.

- Amount: The current rate of the Child Benefit Lump Sum is €600.

- Tax-free: The payment is tax-free, meaning families receive the full amount.

- Application: Families can apply for the Child Benefit Lump Sum through MyWelfare.ie.

- Expenses: The lump sum can be used to cover various expenses related to the new child, such as childcare, clothing, or medical expenses.

- Support: The Child Benefit Lump Sum is part of a range of government supports available to families in Ireland, demonstrating the commitment to supporting families with children.

NYSLRS’ Partial Lump Sum Payments - New York Retirement News - Source nyretirementnews.com

In Ireland, the Child Benefit Lump Sum is an invaluable financial support for families welcoming a new child. It provides families with immediate financial relief and flexibility to cover the essential expenses associated with a growing family. The lump sum plays a vital role in ensuring the well-being and financial security of families in Ireland.

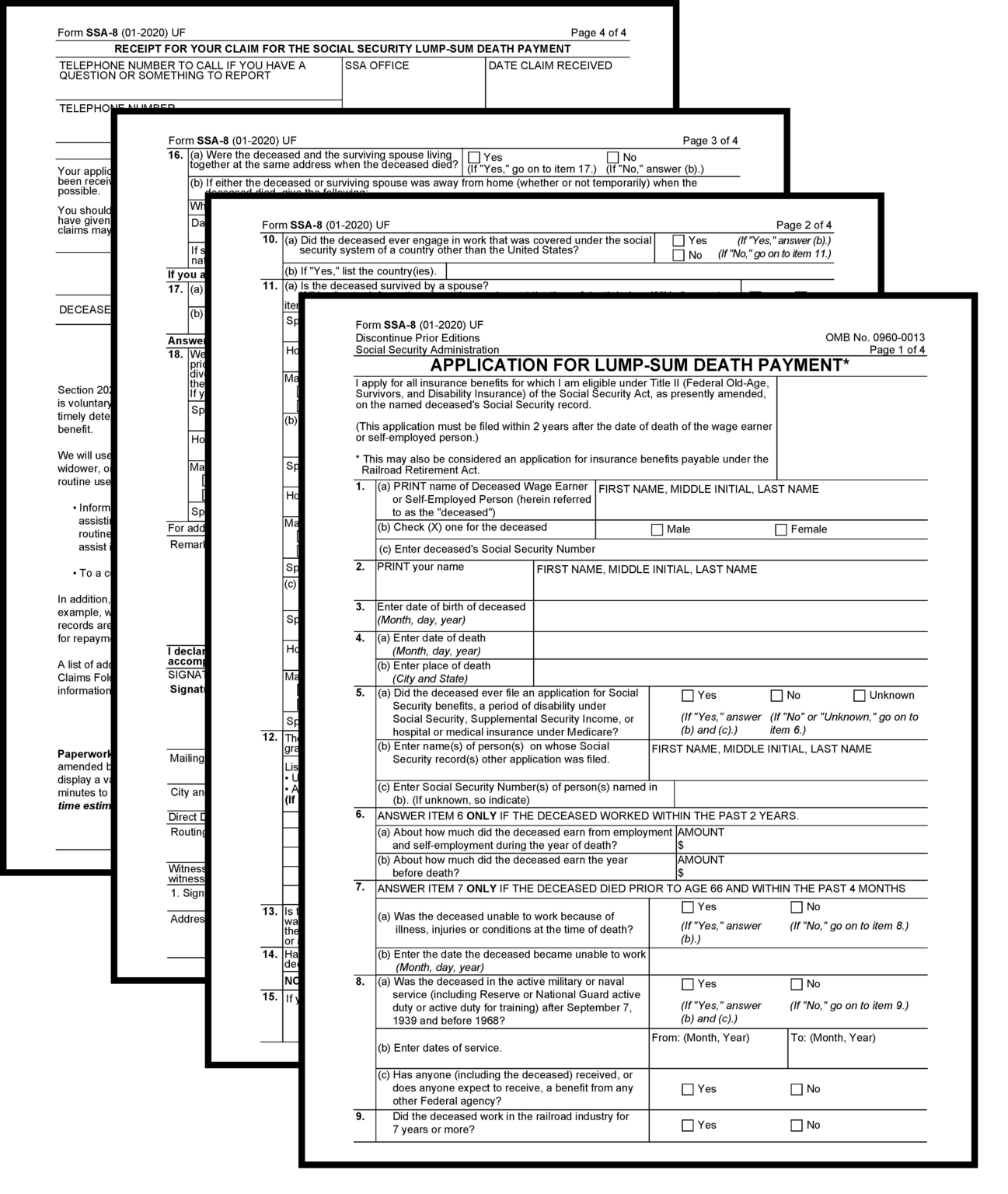

Social Security Lump Sum Benefit Worksheet - Source printableschoolwharfies.z13.web.core.windows.net

Child Benefit Lump Sum: A Guide For Families In Ireland

The Child Benefit Lump Sum is a one-off payment of €600 for each child under 16 years of age. It is paid to the main carer of the child, regardless of their income or employment status. The lump sum is intended to help families with the costs of raising a child, such as childcare, clothing, and food.

A History of the Social Security Death Benefit | Benefit Choice Direct - Source benefitchoicedirect.com

The Child Benefit Lump Sum is a valuable financial support for families in Ireland. It can help to ease the financial burden of raising a child and ensure that all children have the opportunity to reach their full potential.

The Child Benefit Lump Sum is a key part of the Irish government's commitment to supporting families. It is a simple and effective way to provide financial assistance to families with children and helps to ensure that all children in Ireland have the best possible start in life.

| Benefit | Description |

|---|---|

| Tax-free | The lump sum is not taxable, so families can keep the full amount. |

| Paid regardless of income | Families can receive the lump sum regardless of their income or employment status. |

| Simple to apply for | Families can apply for the lump sum online or by post. |

Conclusion

The Child Benefit Lump Sum is a valuable financial support for families in Ireland. It can help to ease the financial burden of raising a child and ensure that all children have the opportunity to reach their full potential.

The Child Benefit Lump Sum is a key part of the Irish government's commitment to supporting families. It is a simple and effective way to provide financial assistance to families with children and helps to ensure that all children in Ireland have the best possible start in life.