CO2 Tax 2027: A Comprehensive Guide To Germany's Carbon Pricing Mechanism

Editor's Notes: "CO2 Tax 2027: A Comprehensive Guide To Germany's Carbon Pricing Mechanism" has published today to address the importance of Carbon Pricing. The decision of the German government to put a price tag on harmful CO2 emissions is a bold step towards combating climate change.

To help our target audience get the most up-to-date information on CO2 Tax 2027: A Comprehensive Guide To Germany's Carbon Pricing Mechanism, we've analyzed, dug into information, and put together this guide.

Video Explainer: Carbon Pricing 101, 41% OFF - Source gbu-taganskij.ru

| Topic | Details |

|---|---|

| What is CO2 Tax 2027? | CO2 Tax 2027 introduces a price on carbon emissions, making polluters pay for the environmental damage they cause. |

| Why is CO2 Tax 2027 important? | It encourages businesses and individuals to reduce their carbon footprint, promoting a shift towards renewable energy and energy efficiency. |

| How will CO2 Tax 2027 affect businesses? | Companies will need to incorporate carbon costs into their operations, leading to potential price increases for consumers and incentives for eco-friendly practices. |

| What are the key takeaways of CO2 Tax 2027? | It's a significant step towards Germany's climate goals, encouraging innovation, and promoting a greener economy. |

Transition to main article topics:

FAQ

Delve into our comprehensive FAQ section to gain detailed insights into the intricate aspects of Germany's CO2 Tax 2027 and its implications.

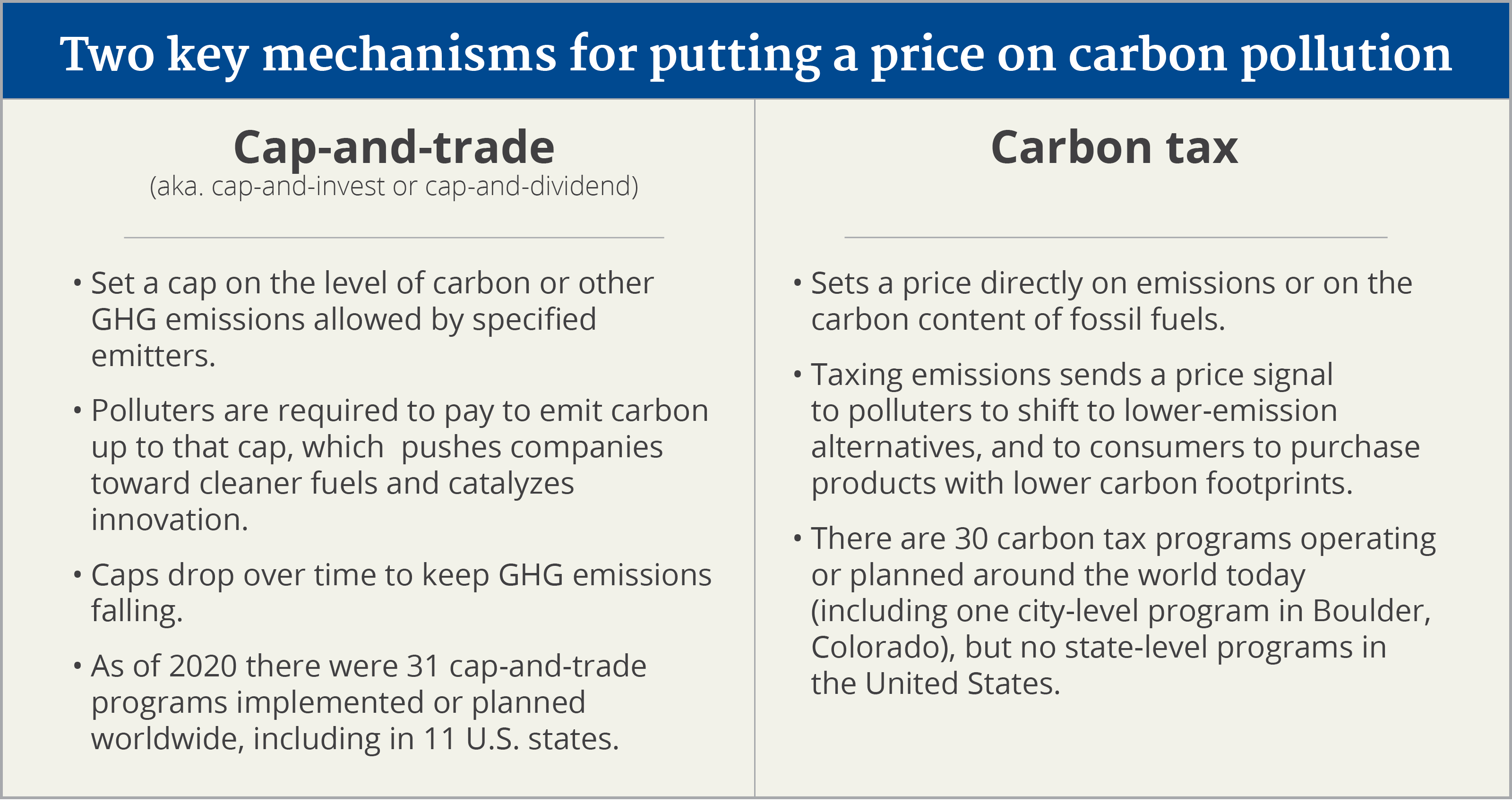

Carbon Pricing 101 - Source publicinterestnetwork.org

Question 1: What is the primary objective of the CO2 Tax 2027?

The CO2 Tax 2027 seeks to drive a substantial reduction in greenhouse gas emissions, aligning with Germany's commitment to achieve climate neutrality by 2045. It aims to encourage businesses and individuals to adopt practices that prioritize sustainability and reduce their carbon footprint.

Question 2: How is the CO2 Tax 2027 structured?

The tax is designed as a price-based mechanism, imposing a fee on fossil fuel emissions. It follows a tiered approach, with different rates assigned to various sectors and industries to account for their respective emission levels.

Question 3: What are the expected impacts of the CO2 Tax 2027?

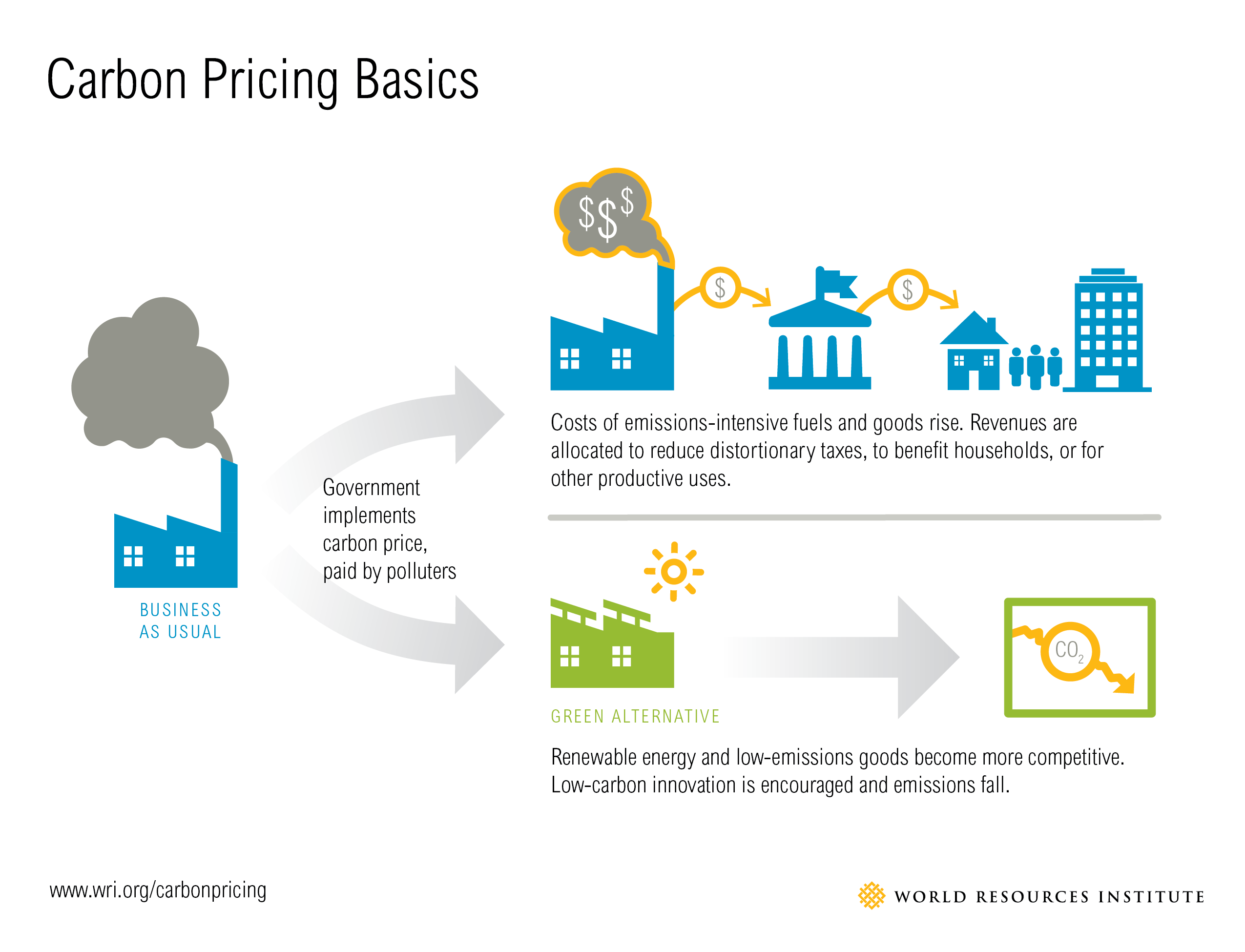

The tax is projected to accelerate the transition towards renewable energy sources, promote energy efficiency measures, and encourage innovation in low-carbon technologies. It is anticipated to play a pivotal role in driving Germany's transformation into a climate-conscious society.

Question 4: How will the revenues generated from the CO2 Tax 2027 be utilized?

The revenues collected will be channeled towards supporting climate protection initiatives, including investments in renewable energy, energy-efficient infrastructure, and research and development in low-carbon technologies.

Question 5: Are there any exemptions or reductions available under the CO2 Tax 2027?

Certain sectors and activities may qualify for exemptions or reductions based on their energy efficiency or contributions to reducing emissions. The government has established a framework outlining the eligibility criteria and processes for obtaining these concessions.

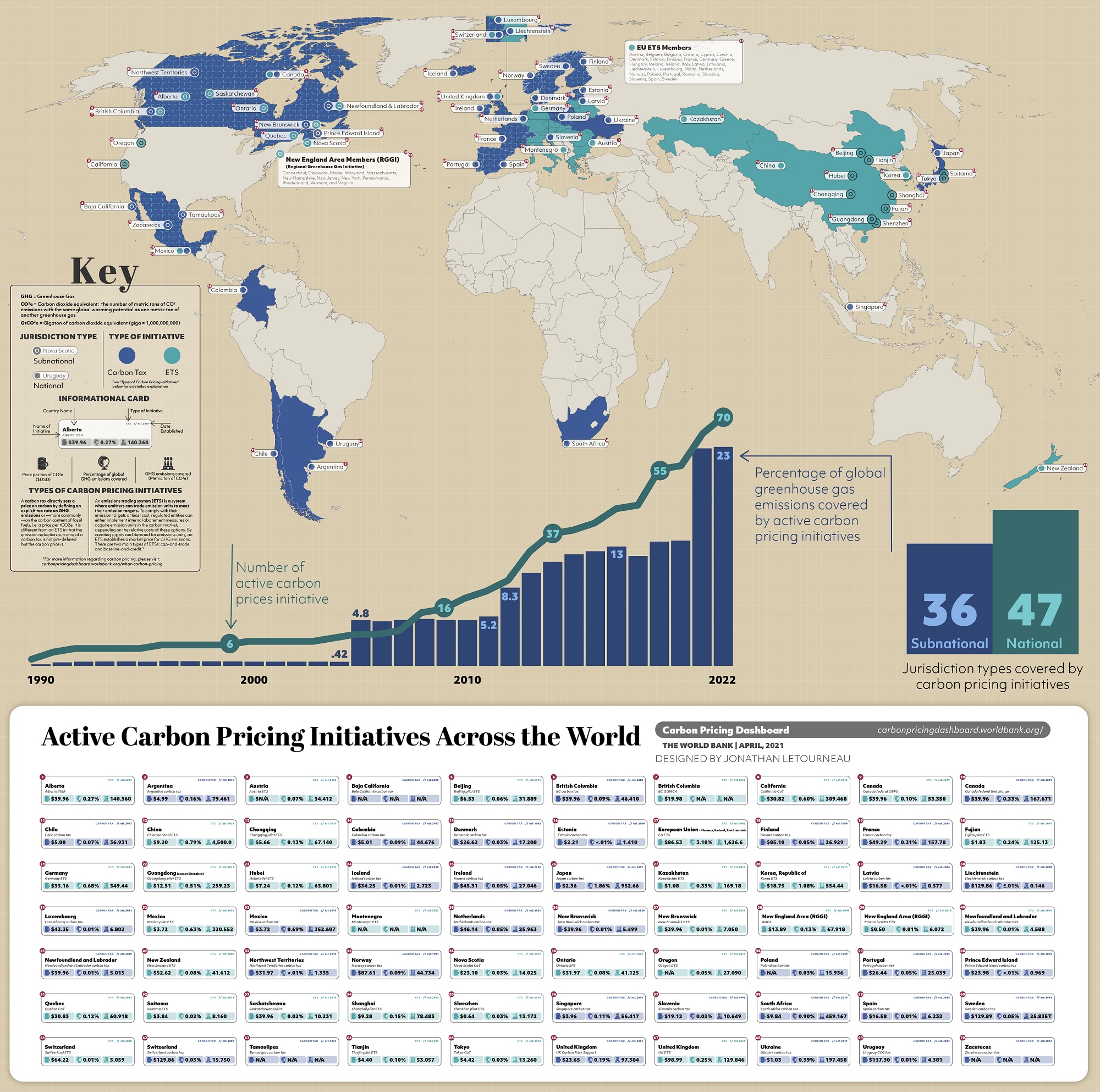

Question 6: How does the CO2 Tax 2027 compare to other international carbon pricing mechanisms?

Germany's CO2 Tax 2027 aligns with the international trend towards carbon pricing, drawing inspiration from successful models implemented in various countries. It is designed to contribute to global efforts to combat climate change and promote sustainable practices.

Conclusion:

The CO2 Tax 2027 represents a vital step in Germany's journey towards achieving climate neutrality. It is a multifaceted policy instrument that leverages market-based mechanisms to drive emissions reduction, while also providing incentives for innovation and investment in sustainable solutions. As Germany navigates the path towards a greener future, the CO2 Tax 2027 will undoubtedly serve as a cornerstone in shaping the country's environmental policies, fostering a cleaner and more sustainable society for generations to come.

Transition to the Next Article Section:

Tips

To help businesses prepare for the CO2 tax, the following tips can be considered:

Tip 1: Assess current greenhouse gas emissions and identify areas for reduction. This can be done through energy audits, process optimization, and supply chain analysis.

Tip 2: Explore energy efficiency measures and invest in renewable energy sources. This could include upgrading equipment, installing solar panels, or switching to more efficient transportation methods.

Tip 3: Consider carbon capture and storage (CCS) technologies, which can help reduce emissions from industrial processes. CCS involves capturing CO2 from exhaust gases and storing it underground.

Tip 4: Engage with suppliers and customers to collaborate on emission reduction strategies. This can involve setting common targets, sharing best practices, and exploring joint investment opportunities.

Tip 5: Conduct regular monitoring and reporting of emissions to track progress and identify areas for further improvement. This can help businesses stay compliant with regulatory requirements and demonstrate their commitment to sustainability.

Tip 6: Stay updated on the latest developments and best practices related to carbon pricing. This can involve attending industry events, reading research papers, and consulting with experts.

Tip 7: Consider joining carbon markets or emissions trading schemes to offset emissions and access financial incentives. This can help businesses reduce their overall carbon footprint and potentially generate revenue.

CO2 Tax 2027: A Comprehensive Guide To Germany's Carbon Pricing Mechanism

Understanding Germany's CO2 Tax 2027 – a comprehensive carbon pricing mechanism – requires an exploration of its key aspects: Scope, Rates, Exemptions, Revenues, Impact, and Implications. These aspects collectively define the mechanism's framework and shape its impact on Germany's transition towards a more sustainable economy.

- Scope: Emissions covered include those from energy, industry, and transportation, with a potential expansion to other sectors in the future.

- Rates: The carbon tax starts at €25 per tonne of CO2 equivalent in 2025, gradually increasing to €55 by 2027 and beyond.

- Exemptions: Certain sectors, such as agriculture, waste incineration, and air transportation, are initially exempted due to their specific circumstances or higher risks of carbon leakage.

- Revenues: Proceeds from the carbon tax are earmarked for climate protection measures, supporting Germany's sustainability initiatives and reducing the economic burden on taxpayers.

- Impact: The tax is expected to encourage businesses and consumers to reduce their carbon emissions, contributing to Germany's overall climate mitigation targets.

- Implications: The CO2 Tax 2027 is a significant step in Germany's climate policy, aligning with the European Union's Emissions Trading System and potentially influencing similar measures in other countries.

The interplay of these aspects highlights the complexity and significance of Germany's CO2 Tax 2027. By incentivizing carbon emission reductions, it aims to accelerate the country's transition to a low-carbon economy, while also generating revenue to fund climate protection measures. The mechanism's impact and implications extend beyond Germany's borders, potentially shaping climate policies and fostering international cooperation in addressing the global challenge of climate change.

Mapped: Carbon Pricing Initiatives Around the World - Source www.visualcapitalist.com

CO2 Tax 2027: A Comprehensive Guide To Germany's Carbon Pricing Mechanism

The German government has implemented a carbon pricing mechanism, known as the CO2 Tax, to reduce greenhouse gas emissions and promote sustainability. The tax will be levied on the consumption of fossil fuels, such as coal, natural gas, and oil, starting in 2027. The tax rate will gradually increase over time, providing incentives for businesses and consumers to shift towards cleaner energy sources.

Carbon Pricing: An Introduction | Enviraj - Source oer.enviraj.com

The CO2 Tax is a significant component of Germany's climate change mitigation strategy. It aims to reduce the country's carbon emissions by 55% by 2030 and achieve carbon neutrality by 2050. The tax revenue will be used to fund investments in renewable energy, energy efficiency measures, and research and development of low-carbon technologies.

The CO2 Tax is expected to have a substantial impact on the German economy. It will increase the cost of fossil fuels, which will likely be passed on to consumers in the form of higher prices for goods and services. However, the tax is also expected to stimulate investment in clean energy and create new jobs in the renewable energy sector.

Germany's CO2 Tax is a bold step towards reducing greenhouse gas emissions and achieving climate goals. It is a model for other countries looking to implement similar policies to address the global climate crisis.

| Year | Tax Rate (€/ton CO2) |

|---|---|

| 2027 | 30 |

| 2028 | 35 |

| 2029 | 40 |

| 2030 | 45 |