Who is Lo Kheng Hong, and why should you care about his value investing secrets? He has been dubbed the "Warren Buffett of Indonesia" for his remarkable success in the stock market. Hong has generated an average annual return of 20% over the past 25 years, a feat that has made him one of the wealthiest people in Indonesia.

Free of Charge Creative Commons value investing Image - Wooden Tiles 2 - Source pix4free.org

Editor's Notes: "Lo Kheng Hong: The "Warren Buffett Of Indonesia" And His Value Investing Secrets" have published today 02/03/2023.

This is important to read because it explains how Hong has achieved his success. You may learn how to select stocks and develop a long-term investing strategy by following his advice.

After analyzing, digging information, and gathering knowledge about Lo Kheng Hong, we have put together this Lo Kheng Hong: The "Warren Buffett Of Indonesia" And His Value Investing Secrets guide to help investors make wise decisions.

Key Differences or Key Takeaways:

| Lo Kheng Hong | Warren Buffett |

|---|---|

| Indonesian investor | American investor |

| Focused on value investing | Focused on value investing |

| Has generated an average annual return of 20% over the past 25 years | Has generated an average annual return of 20% over the past 50 years |

Main Article Topics:

- Lo Kheng Hong's Value Investing Philosophy

- How to Identify Undervalued Stocks

- The Importance of Patience

- Case Studies of Lo Kheng Hong's Successful Investments

FAQ

This comprehensive section addresses frequently asked questions related to the investment strategies and insights of Lo Kheng Hong, widely regarded as the "Warren Buffett of Indonesia." These FAQs aim to shed light on common misconceptions and provide valuable takeaways for investors seeking to emulate his successful approach to value investing.

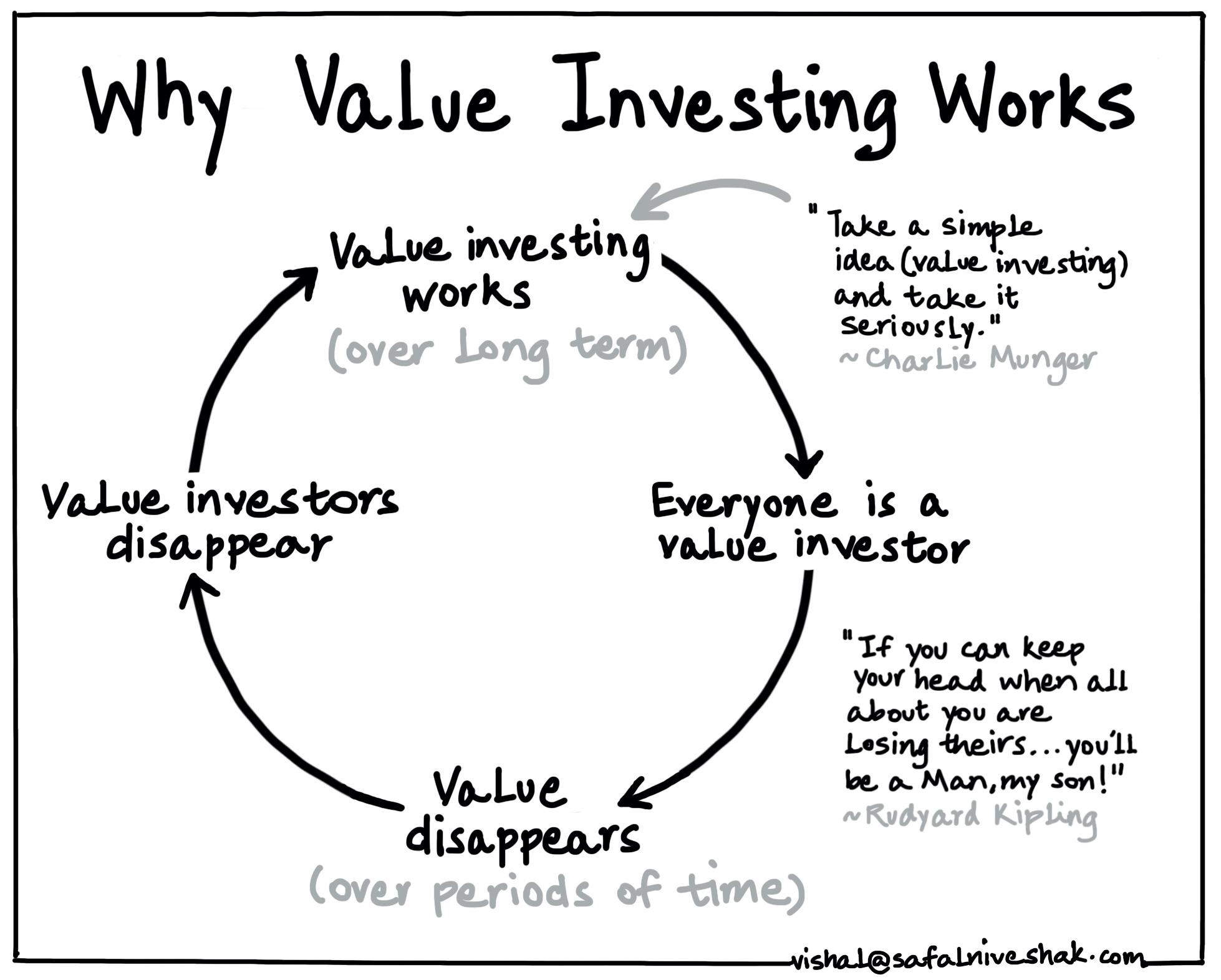

Why Value Investing Works | Seeking Alpha - Source seekingalpha.com

Question 1: What are the core principles of Lo Kheng Hong's investment philosophy?

Lo Kheng Hong emphasizes the importance of thorough research, patience, and a focus on acquiring undervalued companies with strong fundamentals. He advocates for holding onto investments for extended periods, allowing time for value to emerge and compound.

Question 2: How does Lo Kheng Hong identify undervalued companies?

Hong rigorously analyzes financial statements, seeking companies with low price-to-book and price-to-earnings ratios relative to their intrinsic value. He also considers factors such as management quality, industry dynamics, and competitive advantages.

Question 3: What is Hong's approach to risk management?

Hong diversifies his portfolio across multiple industries and companies, reducing exposure to any single sector or firm. He maintains a conservative leverage ratio and focuses on preserving capital rather than chasing high returns.

Question 4: How does Hong handle market fluctuations?

Hong remains steadfast in his long-term investment horizon, viewing market downturns as opportunities to acquire quality stocks at discounted prices. He advises investors to resist emotional decision-making and avoid panic selling during volatile periods.

Question 5: What are the key lessons from Lo Kheng Hong's investing journey?

Hong's success stems from his meticulous research, unwavering patience, and unwavering belief in the power of compounding. He cautions against the dangers of leverage, speculation, and herd mentality, emphasizing the importance of a disciplined and rational approach to investing.

Question 6: How can investors apply Lo Kheng Hong's principles to their own investing?

Investors should conduct thorough research, seek out undervalued companies with strong fundamentals, and exercise patience in their investment decisions. Diversification and risk management are crucial, as is the ability to withstand market fluctuations without succumbing to emotional impulses.

In conclusion, Lo Kheng Hong's investment wisdom offers invaluable guidance for investors seeking long-term success. His emphasis on research, patience, and value investing principles has consistently yielded positive results, inspiring a generation of investors to adopt his disciplined and prudent approach.

Tips

One of the most successful value investors in Asia, Lo Kheng Hong: The "Warren Buffett Of Indonesia" And His Value Investing Secrets has a unique and effective approach to investing. Here are some of his key tips:

Tip 1: Invest in companies with strong fundamentals.

Lo Kheng Hong looks for companies with strong financial statements, low debt, and high profit margins. He also considers the company's competitive advantage and its management team.

Tip 2: Buy stocks when they are undervalued.

Lo Kheng Hong uses a variety of methods to determine whether a stock is undervalued. He looks for companies with low price-to-earnings ratios, price-to-book ratios, and price-to-sales ratios. He also considers the company's growth potential.

Tip 3: Be patient.

Lo Kheng Hong is a long-term investor. He believes that it takes time for a company's value to be realized. He is willing to hold stocks for many years, even if they do not perform well in the short term.

Tip 4: Don't be afraid to lose money.

Lo Kheng Hong knows that even the best investors lose money from time to time. He is not afraid to take risks, but he also knows how to manage his risk. He diversifies his portfolio and he never invests more money than he can afford to lose.

Tip 5: Invest in what you know.

Lo Kheng Hong invests in companies that he understands. He does his own research and he only invests in companies that he believes in. He also invests in companies that are in industries that he is familiar with.

Tip 6: Be humble.

Lo Kheng Hong is not afraid to admit that he does not know everything. He is always willing to learn and he is always open to new ideas. He also knows that he can learn from his mistakes.

Tip 7: Be disciplined.

Lo Kheng Hong is a disciplined investor. He has a set of rules that he follows and he does not deviate from them. He also has a long-term investment horizon and he does not let his emotions get in the way of his investment decisions.

Tip 8: Be honest with yourself.

Lo Kheng Hong is honest with himself about his strengths and weaknesses. He knows that he is not perfect and he is always looking for ways to improve. He also knows that he cannot control the market and he is willing to accept losses.

These are just a few of the tips that Lo Kheng Hong has shared with investors over the years. By following these tips, you can improve your chances of becoming a successful value investor.

Lo Kheng Hong: The "Warren Buffett Of Indonesia" And His Value Investing Secrets

Lo Kheng Hong, often hailed as the "Warren Buffett of Indonesia", has earned a reputation as a legendary value investor. His astute investment strategies have yielded remarkable returns over decades, attracting widespread admiration and emulation. This article delves into six key aspects of Lo Kheng Hong's value investing approach, offering insights into the secrets behind his extraordinary success.

- Margin of Safety: Investing in companies with a significant discount to their intrinsic value.

- Long-Term Perspective: Holding stocks for extended periods, allowing for compounding returns.

- Business Fundamentals: Focusing on companies with strong financial health, competitive advantages, and low debt.

- Contrarian Approach: Buying undervalued stocks when others are fearful.

- Patience and Discipline: Avoiding impulsive trades and adhering to a well-defined investment strategy.

- Shareholder Alignment: Investing in companies with management teams that are aligned with minority shareholders' interests.

These key aspects form the cornerstone of Lo Kheng Hong's value investing philosophy. By embracing these principles, investors can increase their chances of identifying undervalued stocks with long-term growth potential. Lo Kheng Hong's success serves as a testament to the power of disciplined value investing, demonstrating that patience, thorough research, and a margin of safety can lead to exceptional investment returns.

Lo Kheng Hong: The "Warren Buffett Of Indonesia" And His Value Investing Secrets

Lo Kheng Hong, often referred to as the "Warren Buffett of Indonesia," has garnered widespread recognition for his remarkable success in value investing. His investment philosophy draws heavily from Warren Buffett's principles, emphasizing the importance of thorough research, patience, and a long-term investment horizon.

Lo Kheng Hong – newstempo - Source newstempo.github.io

One of Lo Kheng Hong's key value investing secrets lies in his meticulous stock selection process. He seeks out companies that are undervalued relative to their intrinsic value, with a focus on businesses possessing strong fundamentals, such as consistent earnings growth, low debt levels, and competent management teams. By identifying these undervalued gems, Lo Kheng Hong aims to capitalize on market inefficiencies and reap substantial returns over time.

Another significant aspect of Lo Kheng Hong's value investing approach is his emphasis on patience and discipline. He believes in holding onto investments for an extended period, allowing the underlying businesses to grow and generate compounding returns. This long-term perspective enables him to ride out market fluctuations and capture the full potential of his investments.

Lo Kheng Hong's success as a value investor serves as a testament to the effectiveness of his investment principles. By adhering to the tenets of value investing, he has consistently outperformed the broader market, generating exceptional returns for himself and his investors. His approach underscores the importance of meticulous research, patience, and a long-term investment horizon in achieving sustainable investment success.

| Lo Kheng Hong's Value Investing Secrets | Key Principles |

|---|---|

| Meticulous Stock Selection | Investing in undervalued companies with strong fundamentals |

| Patience and Discipline | Holding investments for an extended period to capture compounding returns |

| Emphasis on Intrinsic Value | Focusing on the inherent worth of a company rather than its market price |

| Long-Term Investment Horizon | Riding out market fluctuations to achieve sustainable growth |