In order to provide you with the most comprehensive and up-to-date information, our team has conducted extensive research, analyzed data, and consulted with experts in the field. Our goal is to provide you with a clear and concise guide that will help you make informed decisions about Low-Interest Loans Available For Government Employees In Iran.

| Feature | Low-Interest Loans | Traditional Loans |

|---|---|---|

| Interest Rate | Lower interest rates | Higher interest rates |

| Loan Term | Longer loan terms | Shorter loan terms |

| Eligibility | Only available to government employees | Available to anyone with good credit |

- Lower monthly payments

- More affordable way to borrow money

- Can help consolidate debt

- Can help improve credit score

In order to qualify for a low-interest loan, you will need to meet certain requirements. These requirements may vary depending on the lender, but they typically include:

- Being a government employee

- Having a good credit score

- Having a steady income

- Having a low debt-to-income ratio

Low-Interest Loans Available For Government Employees In Iran are a valuable resource that can help government employees save money and improve their financial situation. If you are a government employee, you should consider applying for a low-interest loan today.

FAQ

This FAQ section provides answers to commonly asked questions about low-interest loans available for government employees in Iran.

Question 1: Who is eligible for these loans?

Answer: These loans are available to all active and retired government employees in Iran.

Question 2: What are the interest rates on these loans?

Answer: The interest rates on these loans are set by the Iranian government and vary depending on the loan amount and term.

Question 3: What are the repayment terms for these loans?

Answer: The repayment terms for these loans vary depending on the loan amount and term.

Question 4: How do I apply for these loans?

Answer: You can apply for these loans through your employer or through a participating financial institution.

Question 5: What are the benefits of these loans?

Answer: These loans can provide government employees with a number of benefits, including:

- Low interest rates

- Flexible repayment terms

- Quick and easy application process

Question 6: What are the risks of these loans?

Answer: As with any loan, there are some risks associated with these loans. These risks include:

- The possibility of defaulting on the loan

- The possibility of the interest rate increasing

- The possibility of the repayment terms changing

Low interest loans for startups, street vendors, small businesses. Debt - Source www.vecteezy.com

It is important to weigh the benefits and risks of these loans carefully before applying for one.

For more information, please contact your employer or a participating financial institution.

Tips for Obtaining Low-Interest Loans as a Government Employee in Iran

Government employees in Iran are eligible for several programs offering low-interest loans. Low-Interest Loans Available For Government Employees In Iran These loans can be used for various purposes, including purchasing a home, starting a business, or consolidating debt. If you are a government employee in Iran, here are a few tips to help you get started:

Tip 1: Research different loan programs.

There are several different low-interest loan programs available to government employees in Iran. Each program has its eligibility requirements and interest rates. It is important to research the different programs to find the one that best meets your needs.

Tip 2: Get your financial documents in order.

When you apply for a loan, you will need to provide the lender with a variety of financial documents. These documents may include your pay stubs, bank statements, and tax returns. Getting your financial documents in order will help you speed up the loan application process.

Tip 3: Shop around for the best interest rate.

Once you have found a few different loan programs that you are eligible for, it is important to shop around for the best interest rate. The interest rate on your loan will have a significant impact on your monthly payments. Comparing interest rates from different lenders will help you save money over the life of your loan.

Tip 4: Be prepared to make a down payment.

Most lenders will require you to make a down payment on your loan. The amount of the down payment will vary depending on the lender and the loan program. Having a larger down payment will help you get a lower interest rate.

Tip 5: Be prepared to provide collateral.

Some lenders may require you to provide collateral for your loan. Collateral is an asset that you can offer to the lender in case you default on your loan. Providing collateral can help you get a lower interest rate.

Summary:

By following these tips, you can increase your chances of getting a low-interest loan as a government employee in Iran. Low-interest loans can help you save money, achieve your financial goals, and improve your quality of life.

Low-Interest Loans Available For Government Employees In Iran

The Iranian government offers low-interest loans to its employees as a means of financial support and economic empowerment.

Solved Janis Jones works for the Bank of Montreal. The bank | Chegg.com - Source www.chegg.com

- Eligibility: Government employees are eligible for these loans based on specific criteria.

- Purpose: The loans can be used for various purposes, including housing, education, and medical expenses.

- Low Interest Rates: The loans are characterized by low-interest rates compared to market rates.

- Flexible Repayment Options: The loans offer flexible repayment options to suit the financial capabilities of the employees.

- Government Subsidies: The government subsidizes the loans, making them more affordable for the employees.

- Economic Benefits: The loans contribute to the financial well-being of government employees and stimulate economic growth.

These key aspects highlight the importance and benefits of low-interest loans for government employees in Iran. They provide financial assistance, promote economic empowerment, and support the overall well-being of the employees, contributing to the country's economic development.

Low-Interest Loans Available For Government Employees In Iran

In Iran, government employees are entitled to low-interest loans as a means of financial assistance and support. These loans are designed to provide government employees with access to affordable financing, enabling them to meet various financial obligations and improve their overall well-being. Low-interest loans can cater to a wide range of needs, such as purchasing a home, funding higher education, or covering unexpected expenses.

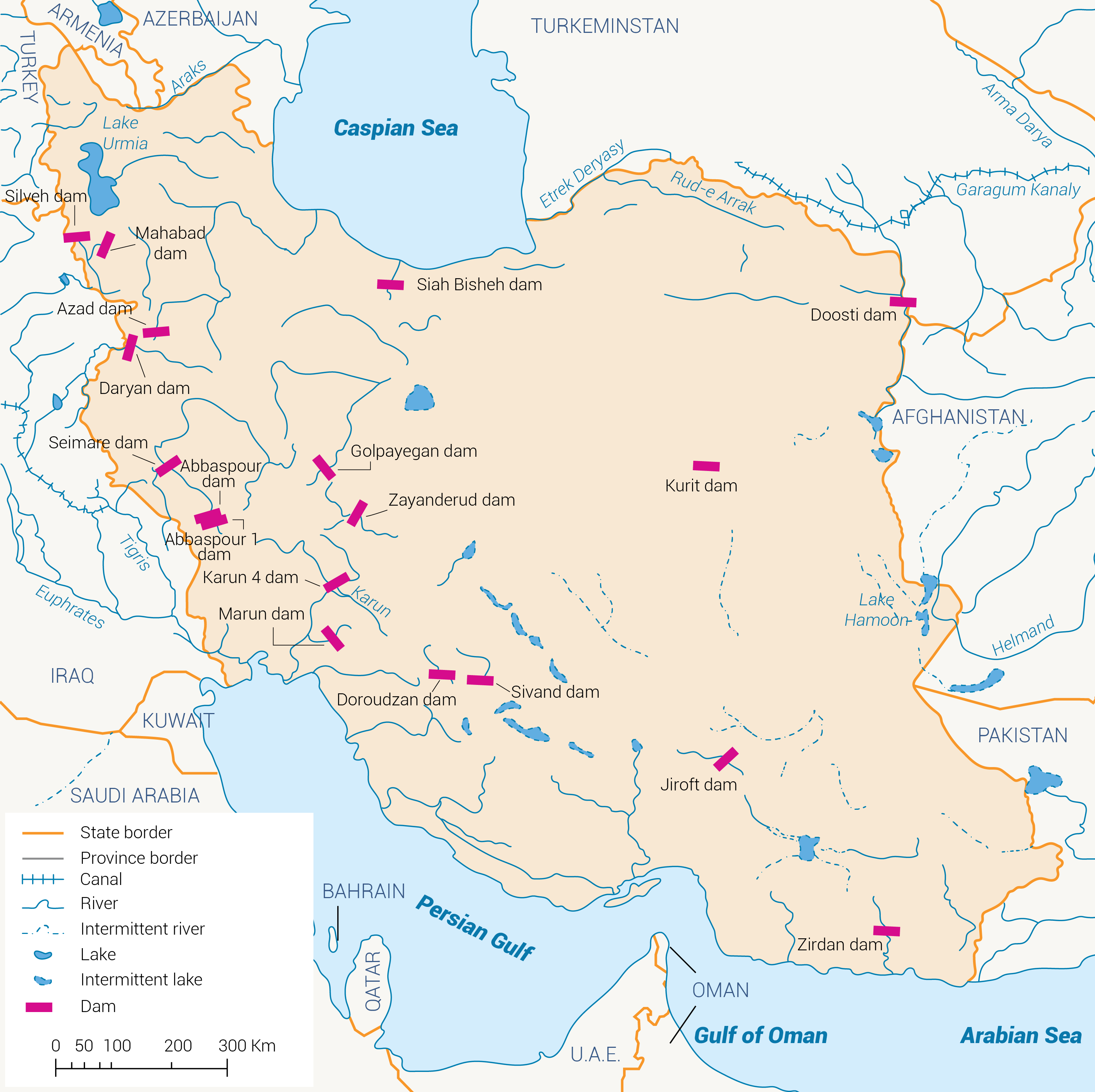

Water Infrastructure in Iran - Fanack Water - Source water.fanack.com

The availability of low-interest loans for government employees holds several key advantages. Firstly, it helps to promote financial stability among government employees, reducing the burden of high-interest debt and providing a safety net during times of financial difficulty. Secondly, these loans can serve as an incentive for individuals to join or remain employed in the public sector, fostering a sense of loyalty and commitment. Thirdly, low-interest loans contribute to the overall economic development of Iran by stimulating spending and investment, particularly in sectors such as housing and education.

The provision of low-interest loans to government employees is not without its challenges. One potential issue is the risk of loan defaults, particularly in cases where borrowers experience financial hardship or job loss. To mitigate this risk, thorough credit assessments and financial counseling services are crucial. Additionally, the government must ensure that the loan program is sustainable and financially viable over the long term.

In conclusion, low-interest loans for government employees play a vital role in supporting the financial well-being of public sector workers in Iran. They provide access to affordable financing, promote financial stability, and contribute to economic development. However, careful management and risk mitigation strategies are essential to ensure the long-term success and sustainability of the program.

Table: Key Insights on Low-Interest Loans for Government Employees in Iran

| Feature | Benefit |

|---|---|

| Affordable financing | Reduced financial burden, improved well-being |

| Incentive for public sector employment | Fosters loyalty, commitment |

| Economic development | Stimulates spending, investment |

| Risk of loan defaults | Requires thorough credit assessments, financial counseling |

| Sustainability | Essential for long-term viability |