Do you need a low-interest loan but don't have any collateral? Low-Interest Loans For Subsidized Borrowers: No Collateral Required are available to help you get the money you need without having to put your assets at risk.

Editor's Note: Low-Interest Loans For Subsidized Borrowers: No Collateral Required have been published on [today's date]. We understand that many people are struggling financially, and we want to provide them with information about all of the options that are available to them.

We've done some analysis, digging information, made comparisons, and put together this Low-Interest Loans For Subsidized Borrowers: No Collateral Required guide to help you make the right decision.

Here are some of the key differences between Low-Interest Loans For Subsidized Borrowers: No Collateral Required and other types of loans:

| Feature | Low-Interest Loans For Subsidized Borrowers: No Collateral Required | Other Types of Loans |

|---|---|---|

| Interest rate | Low (typically below 5%) | Higher (typically above 10%) |

| Loan amount | Up to $100,000 | Varies |

| Loan term | Up to 10 years | Varies |

| Collateral | No collateral required | Collateral required |

Low-Interest Loans For Subsidized Borrowers: No Collateral Required are a great option for people who need to borrow money but don't have any collateral to secure a loan. These loans have low interest rates, long loan terms, and no collateral requirements. If you're struggling financially, you should consider applying for a Low-Interest Loans For Subsidized Borrowers: No Collateral Required.

FAQ

Explore common questions and answers about low-interest loans for subsidized borrowers. These loans offer favorable terms, including no collateral requirement, to eligible borrowers in need of financial assistance.

Top 4 Questions: Direct Subsidized Loans vs. Direct Unsubsidized Loans - Source studentaid.gov

Question 1: What is the purpose of low-interest loans for subsidized borrowers?

These loans aim to provide accessible financing options for individuals who meet specific criteria. Subsidized loans often have below-market interest rates and flexible repayment terms, making them suitable for borrowers with limited financial resources or those pursuing education or affordable housing.

Question 2: Who qualifies as a subsidized borrower?

Eligibility for subsidized loans typically depends on factors such as income level, household size, and credit history. Borrowers may need to demonstrate financial need or meet certain income thresholds to qualify for subsidized loans with lower interest rates.

Question 3: What types of expenses can be covered by these loans?

Subsidized loans can cover a wide range of expenses, including educational costs such as tuition, fees, and books, as well as housing-related expenses like mortgage payments or rent. The specific uses of the loan may vary depending on the loan program.

Question 4: Are there any collateral requirements for these loans?

Typically, low-interest loans for subsidized borrowers do not require any form of collateral. This feature makes them particularly accessible to individuals who may not have assets to secure a traditional loan.

Question 5: How do interest rates compare to other loan options?

Subsidized loans generally offer lower interest rates compared to unsecured personal loans or credit cards. The government or other organizations may subsidize or cover part of the interest, resulting in significant cost savings for eligible borrowers.

Question 6: What are the repayment terms for these loans?

Repayment terms for subsidized loans can vary depending on the loan program and lender. Some loans may offer extended repayment periods or reduced monthly payments to accommodate borrowers' financial situations.

Understanding the details and requirements of low-interest loans for subsidized borrowers is crucial for making informed decisions about financing options. These loans can provide valuable financial assistance to qualified borrowers, enabling them to pursue their education or secure affordable housing.

Next, let's explore the advantages and considerations of these loans to gain a comprehensive understanding.

Tips

Explore and consider the various options available to secure low-interest loans for subsidized borrowers who do not have collateral to offer.

Tip 1: Research government-backed loans like those offered by the U.S. Small Business Administration (SBA). These loans typically come with favorable interest rates and repayment terms, catering specifically to small businesses and start-ups.

Tip 2: Investigate non-profit organizations dedicated to supporting businesses in need of funding. Often, these organizations offer loans with flexible criteria and low-interest rates to help businesses grow and succeed.

Tip 3: Utilize crowdfunding platforms to raise funds from a large pool of individual investors. While this method requires effort in promoting the campaign, it offers the potential for business owners to secure funding without incurring debt.

Tip 4: Explore peer-to-peer lending platforms that connect borrowers with individual lenders. These platforms can provide access to low-interest loans, though it's crucial to compare interest rates and fees carefully.

Tip 5: Consider microloans, which are small loans typically offered to businesses that face difficulty obtaining traditional financing. Microloans often have shorter repayment terms and are designed to support small-scale business ventures.

By exploring these tips, subsidized borrowers can increase their chances of securing low-interest loans without the requirement of collateral. This access to funding can empower businesses to grow and thrive, contributing to economic development and job creation.

Low-Interest Loans For Subsidized Borrowers: No Collateral Required

Low-Interest Loans For Subsidized Borrowers: No Collateral Required

Low-interest loans are a crucial financial tool for subsidized borrowers, often lacking collateral. These loans offer several key aspects:

- Subsidized Rates: Interest rates below market, reducing overall borrowing costs.

- No Collateral: Eliminating the need for assets as security, making loans accessible to a broader range of borrowers.

- Flexible Terms: Loan durations and repayment schedules tailored to individual circumstances.

- Government-Backed: Loans often backed by government agencies, ensuring their reliability and security.

- Targeted Assistance: Loans designed to support specific groups, such as first-time homebuyers or small businesses.

- Economic Impact: Low-interest loans stimulate economic activity by providing access to capital for borrowers with limited resources.

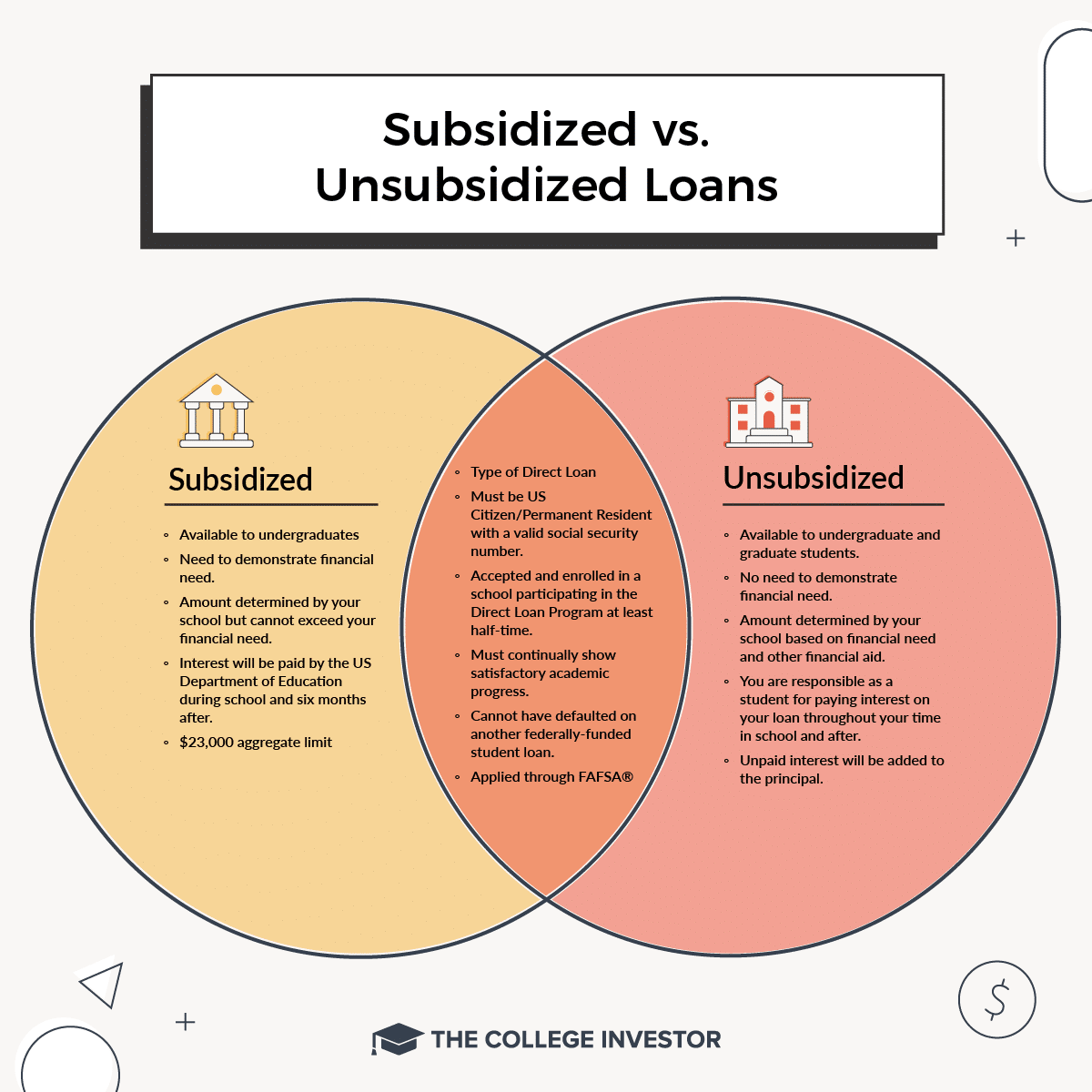

Subsidized vs. Unsubsidized Student Loans - Source thecollegeinvestor.com

For example, subsidized borrowers can use low-interest loans without collateral to finance homeownership, business expansion, or educational expenses. These loans empower individuals and support economic growth. Understanding the key aspects of low-interest loans for subsidized borrowers can enhance financial literacy and empower informed decision-making.

Low-Interest Loans For Subsidized Borrowers: No Collateral Required

"Low-Interest Loans For Subsidized Borrowers: No Collateral Required" explores the advantageous financial assistance available to borrowers with limited means. These loans provide access to capital without the burden of putting up collateral, enabling subsidized borrowers to pursue their goals and improve their financial stability. Understanding the connection between low-interest loans and subsidized borrowers highlights the importance of financial inclusion, promotes economic growth, and empowers individuals to achieve their aspirations.

Subsidized Loans vs Unsubsidized Loans - Source www.caminofinancial.com

Real-life examples showcase the transformative impact of these loans. Small business owners can secure capital to launch or expand their ventures, while students can finance their education and invest in their futures. Non-profit organizations also benefit, with access to funds for community development initiatives and social welfare programs. The absence of collateral requirements makes these loans accessible to underserved populations, fostering equitable access to financial resources.

Practically, understanding this connection can guide financial decision-making. Individuals and organizations can explore subsidized loan options, assess eligibility criteria, and navigate the application process effectively. Financial institutions and policymakers recognize the significance of these loans and allocate resources accordingly, ensuring a sustainable and inclusive financial ecosystem.

| Feature | Impact |

|---|---|

| Low-Interest Rates | Reduced financial burden, increased affordability |

| No Collateral Requirement | Enhanced accessibility, empowers underserved borrowers |

| Subsidized Loans | Government support, lower overall costs |

| Real-Life Benefits | Economic growth, improved life outcomes, community development |

| Practical Significance | Financial inclusion, informed decision-making, sustainable financial ecosystem |