March Payroll Processing: The Ultimate Guide for Employers

Editor's Notes: This comprehensive guide, published today, provides employers with an in-depth understanding of March payroll processing and its crucial implications.

After thorough analysis and extensive research, we have compiled this guide to empower employers in navigating the complexities of March payroll processing efficiently and effectively.

| Key Differences | One | Two |

|---|---|---|

| Importance | Ensures timely and accurate payment of salaries. | Complies with legal and regulatory requirements. |

| Benefits | Improves employee morale and productivity. | Strengthens relationships with employees and stakeholders. |

What is Payroll? An All-in-One Guide to Payroll Processing | UBS - Source ubsapp.com

Main Article Topics:

FAQ

This comprehensive guide aims to provide employers with a thorough understanding of March payroll processing. To further assist, we have compiled a list of frequently asked questions to address common concerns and misconceptions.

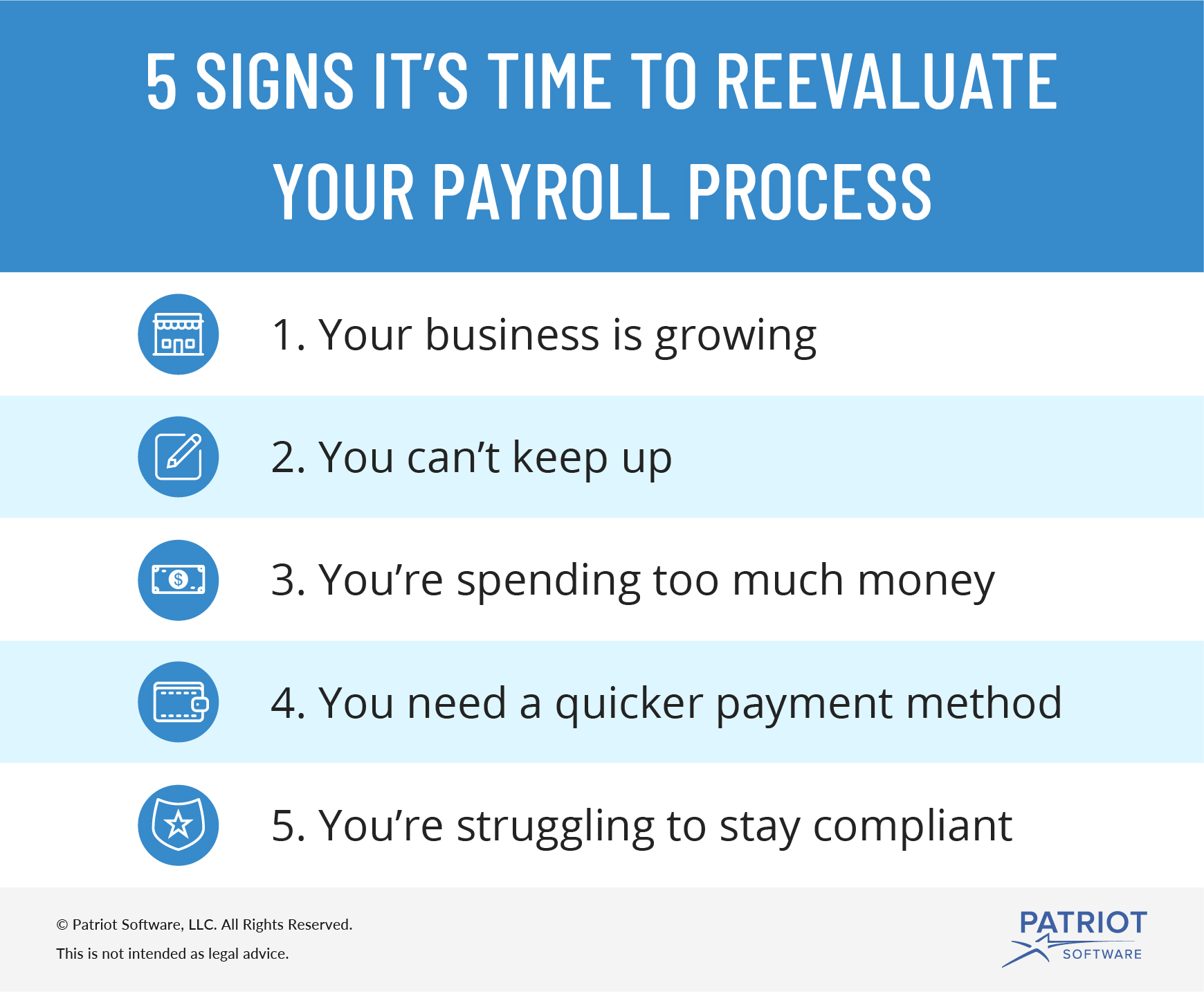

Reevaluating Your Payroll Processing Procedures | Signs & Steps - Source www.patriotsoftware.com

Question 1: When is the deadline for March payroll submissions?

The deadline for March payroll submissions varies depending on the location and any applicable holidays. Employers are advised to consult official guidelines or contact their payroll provider for specific deadlines.

Question 2: What tax forms are required for March payroll?

The specific tax forms required for March payroll depend on factors such as employee status, income levels, and deductions. Employers should refer to relevant tax authorities for detailed information on applicable forms.

Question 3: How do I handle payroll for employees who have recently joined or left the company?

For new employees, employers need to initiate the onboarding process, including collecting necessary information and setting up payroll deductions. For departing employees, employers must finalize their payroll, issue termination payments, and comply with any applicable tax reporting requirements.

Question 4: What are the common deductions that may affect March payroll?

Common deductions that may impact March payroll include federal and state income taxes, Social Security and Medicare contributions, health insurance premiums, and retirement plan contributions. Employers should carefully review employee elections and ensure accurate calculations.

Question 5: How can I ensure the accuracy of March payroll?

To ensure payroll accuracy, employers should implement a systematic approach that includes thorough data entry, regular reconciliations, and reviews by authorized personnel. Utilizing payroll software or outsourcing to a reputable provider can further enhance accuracy and efficiency.

Question 6: What are the potential consequences of incorrect March payroll processing?

Incorrect payroll processing can lead to penalties, fines, and reputational damage. Employers should prioritize accuracy and compliance to avoid such consequences and maintain employee trust.

By addressing these common questions, employers can gain a clearer understanding of March payroll processing requirements and effectively manage their payroll responsibilities.

Transitioning to the next article section: In the subsequent sections, we will delve into the intricate details of March payroll processing, providing practical guidance and expert insights to empower employers in meeting their obligations with precision and efficiency.

Tips: March Payroll Processing

.jpg)

BerniePortal Payroll Processing Checklist - Source blog.bernieportal.com

Effective March payroll processing is crucial for ensuring timely and accurate payments to employees. Here are essential tips to guide employers through this process:

Tip 1: Gather Necessary Information

Collect employee time sheets, expense reports, and any relevant deductions or benefits information. This ensures accurate calculations and deductions.

Tip 2: Calculate Gross Pay

Multiply employee hours worked or units produced by the appropriate pay rate. Add any bonuses, commissions, or other earnings to determine gross pay.

Tip 3: Deduct Taxes and Contributions

Based on employee information, calculate and deduct federal, state, and local income taxes, Social Security, Medicare, and other mandatory contributions.

Tip 4: Include Voluntary Deductions

Process voluntary deductions such as health insurance premiums, retirement contributions, or union dues as authorized by each employee.

Tip 5: Calculate Net Pay

Subtract total deductions from gross pay to arrive at net pay, the amount to be paid to employees.

Tip 6: Provide Pay Stubs

Issue pay stubs to employees, detailing gross pay, deductions, taxes, and net pay. This ensures transparency and employee understanding of their compensation.

Tip 7: File and Pay Taxes

Timely file and pay federal, state, and local payroll taxes, including income taxes, Social Security, and Medicare. Failure to do so can result in penalties.

Tip 8: Maintain Accurate Records

Keep detailed records of all payroll transactions, including time sheets, pay stubs, and tax filings. These records are essential for audits, compliance, and employee inquiries.

By following these tips, employers can streamline March payroll processing, ensure accuracy, comply with regulations, and maintain a positive relationship with their employees.

For a comprehensive guide on March payroll processing, refer to the March Payroll Processing: Essential Guide For Employers.

March Payroll Processing: Essential Guide For Employers

March payroll processing presents unique considerations for employers. To ensure accurate and timely disbursements, employers must adhere to critical aspects such as compliance, calculations, and reporting.

Payroll Processing and the Entrepreneur: The Impact on Employers and - Source www.go.netline.com

By focusing on these essential aspects, employers can streamline their March payroll processes, ensuring timely and accurate disbursements while maintaining compliance and employee satisfaction.

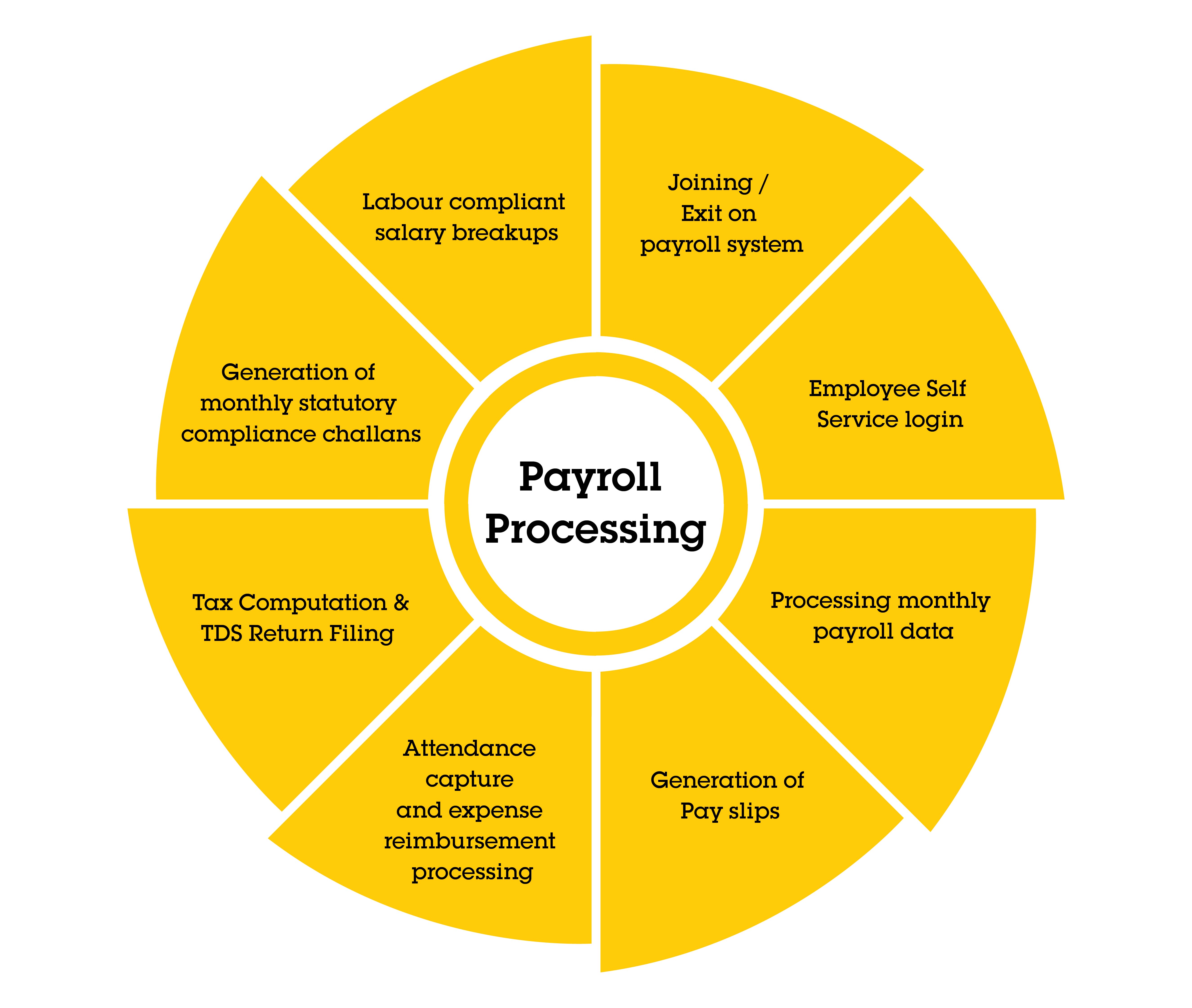

Payroll Processing - Talisman - Source www.talismanstaffing.com

March Payroll Processing: Essential Guide For Employers

The connection between "March Payroll Processing: Essential Guide For Employers" lies in the importance of accurate and timely payroll processing to ensure employees receive their salaries on time, comply with legal regulations, and maintain a positive working environment. It serves as a comprehensive resource for employers, addressing essential payroll processing tasks, legal considerations, and industry best practices.

Payroll Processing & Administration - Sam Bond Benefit Group PEO - Source sbrecommend.com

Understanding this guide is crucial for employers as it provides a clear understanding of payroll processing responsibilities, including calculating withholding taxes, deductions, and ensuring compliance with federal and state regulations. By following these guidelines, employers can efficiently process payroll and ensure adherence to legal requirements.

Furthermore, this guide serves as a valuable tool for payroll professionals who seek to enhance their knowledge and stay abreast of the latest payroll processing trends. It offers practical insights into automation, technology advancements, and best practices for payroll management. By leveraging this resource, employers and payroll professionals can streamline payroll operations and enhance their overall efficiency.

In conclusion, "March Payroll Processing: Essential Guide For Employers" stands as a valuable resource for employers and payroll professionals alike. Its comprehensive coverage of payroll processing tasks, legal compliance, and industry best practices empowers organizations to efficiently manage payroll operations, ensuring timely salary payments and maintaining a positive work environment.