Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat

Editor's Notes: "Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat" have published today, on [Date].

We are well aware of the nefarious practices employed by predatory lenders in the world of "Pinjol Ilegal". After conducting extensive research and analysis, we have put together this "Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat" to assist our valued readers and target audience in making informed decisions about this pressing topic.

Key Differences or Key Takeaways

Transition to Main Article Topics

FAQs

This FAQ section provides answers to commonly asked questions and addresses misconceptions about the dangers of illegal online lending or "pinjol ilegal." Understanding these issues is crucial to avoiding the debt traps and financial ruin they can cause.

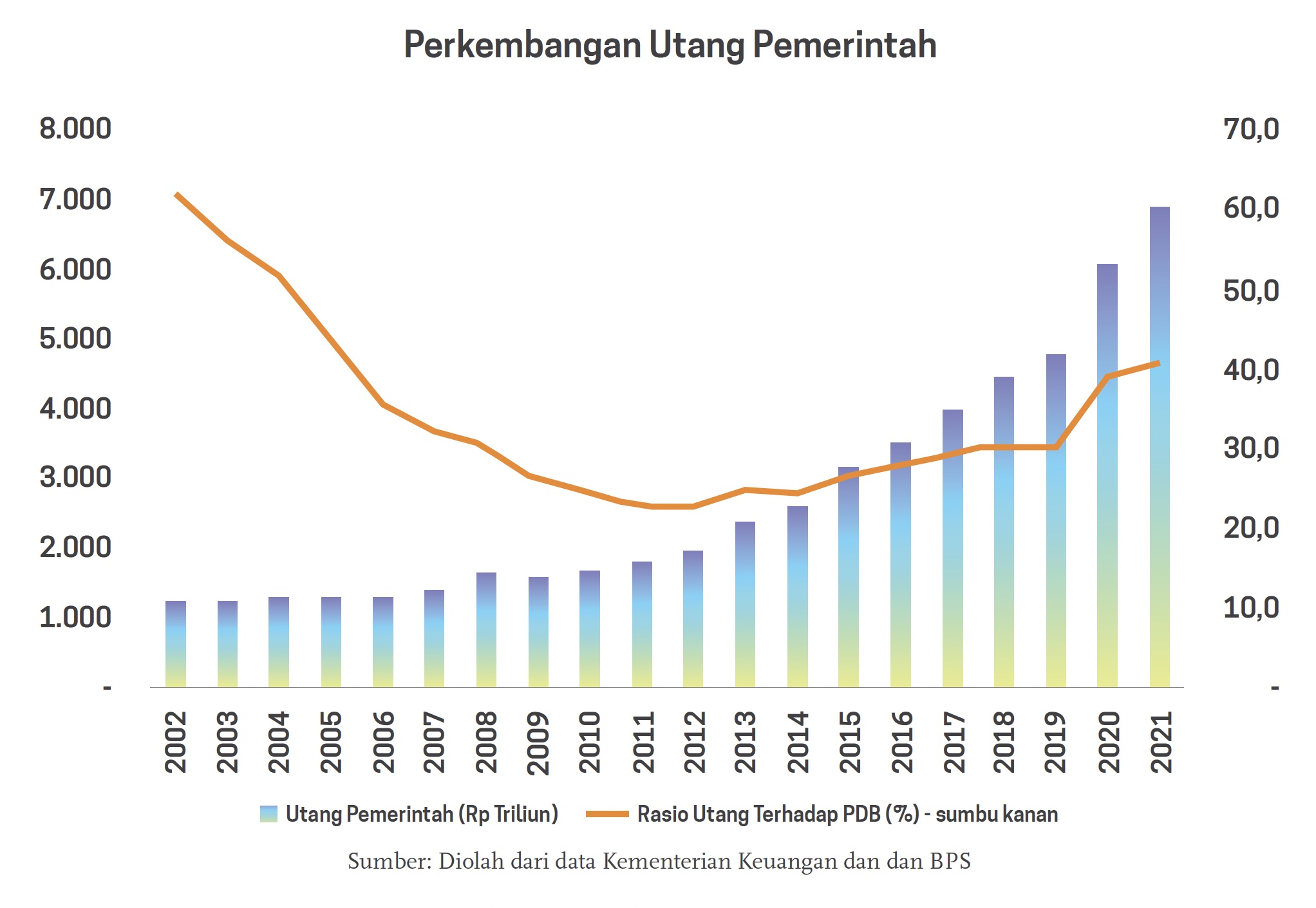

3 Indikator Utang yang Sehat - Datanesia - Source datanesia.id

Question 1: What are the risks of borrowing from illegal online lenders?

Borrowing from illegal online lenders exposes individuals to predatory lending practices, including exorbitant interest rates, hidden fees, and aggressive debt collection tactics. These lenders often operate outside of legal frameworks, leaving borrowers vulnerable to exploitation and harassment.

Question 2: How can I identify illegal online lenders?

Illegal online lenders typically exhibit certain red flags, such as: operating without proper licensing or registration, offering loans with extremely high interest rates, and using deceptive marketing tactics to lure borrowers. It is important to thoroughly research lenders and verify their legitimacy before taking out a loan.

Question 3: What are the legal consequences of borrowing from illegal online lenders?

Borrowing from illegal online lenders may result in legal consequences, such as: prosecution for violating lending laws, seizure of assets to repay debts, and damage to credit scores. These lenders often engage in illegal activities, putting borrowers at risk of legal entanglements.

Question 4: What steps can I take if I have borrowed from an illegal online lender?

If you have borrowed from an illegal online lender, it is important to: cease making payments, report the lender to authorities, and seek legal advice. Financial institutions, credit bureaus, and government agencies can assist in resolving the issue and protecting your rights.

Question 5: How can I prevent falling into debt traps from illegal online lenders?

To prevent falling into debt traps, individuals should: avoid borrowing from illegal online lenders, carefully research lenders before taking out loans, understand the terms and conditions of loans, and seek financial counseling if needed. It is crucial to be cautious and make informed financial decisions.

Question 6: What role do government and financial institutions play in combating illegal online lending?

Government and financial institutions play a vital role in combating illegal online lending by: enforcing lending laws, regulating the industry, and providing support to victims of predatory lending. Collaboration between these stakeholders is essential to protect consumers and ensure a fair and ethical financial system.

By understanding these FAQs, individuals can arm themselves with knowledge and protect themselves from the dangers of illegal online lending. Remember, responsible borrowing and informed decision-making are key to financial stability and well-being.

Proceed to the next article section for further insights on illegal online lending.

Tips to Curb the Debt Trap of Illegal Lending

Waspada Jebakan Utang Membidik Pendidikan Islam - LenSa MediaNews - Source lensamedianews.com

The proliferation of illegal lending practices, commonly known as "pinjol ilegal," poses a significant threat to financial stability and the well-being of individuals. These unscrupulous lenders often prey on vulnerable borrowers with predatory terms and exorbitant interest rates, leading them into a cycle of unsustainable debt. To effectively combat this issue, it is crucial to empower borrowers with knowledge and practical tips to avoid the pitfalls of illegal lending and its devastating consequences.

Tip 1: Be Vigilant and Verify Credibility:

Before engaging with any lender, thoroughly research and verify their legitimacy. Check if they are registered with the appropriate regulatory authorities and have a verifiable physical address. Avoid lenders who operate solely online or through obscure platforms.

Tip 2: Understand the Loan Agreement Thoroughly:

Pay meticulous attention to the loan terms, including the interest rates, repayment schedule, and any penalties for late payment. Do not sign any agreement you do not fully comprehend. If necessary, seek legal advice or consult with trusted financial advisors.

Tip 3: Limit Borrowing and Avoid Multiple Loans:

To prevent falling into a debt spiral, borrow only what is absolutely necessary. Avoid obtaining loans from multiple lenders simultaneously, as this can quickly overwhelm your ability to repay. Prioritize repaying existing loans before considering additional borrowing.

Tip 4: Explore Alternative Lending Options:

Consider seeking financial assistance from reputable sources such as formal banking institutions, credit unions, or government-backed loan programs. These options typically offer more favorable terms and are less likely to engage in predatory practices.

Tip 5: Report Illegal Lending Activities:

If you encounter any suspicious or illegal lending activities, do not hesitate to report them to the relevant authorities. This helps disrupt their operations and prevents others from falling prey to their schemes. Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat

Summary:

By adhering to these tips, individuals can significantly reduce the risk of falling into the debt trap of illegal lending. It is imperative to remain vigilant, educate yourself about the dangers of pinjol ilegal, and seek support from reputable sources when seeking financial assistance.

Conclusion:

Combating illegal lending requires a concerted effort from borrowers, authorities, and financial institutions. By empowering borrowers with knowledge and legal recourse, we can collectively curb the scourge of pinjol ilegal and protect the financial well-being of our society.

Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat

Pinjol ilegal, or illegal online lending, is a growing problem in Indonesia. These lenders often target vulnerable people with high interest rates and predatory lending practices. As a result, many people fall into debt traps that they cannot escape.

Bahaya Jebakan Utang - schmu.id - Source news.schmu.id

By addressing these key aspects, Indonesia can take significant strides towards curbing the menace of pinjol ilegal and protecting its citizens from financial exploitation.

Jebakan Utang China dan Upaya Neo-kolonialisme - Source www.tangerangnews.com

Pinjol Ilegal 2025: Mengekang Jebakan Utang Yang Menjerat

The rapid rise of illegal online lending, or "pinjol ilegal," in Indonesia poses a significant threat to financial stability and consumer welfare. This report, "Pinjol Ilegal 2025: Mengekang Jebakan Utang yang Menjerat," investigates the causes and consequences of pinjol ilegal and proposes measures to combat this pressing issue.

Jebakan Utang Luar Negeri – Mazaya Post - Source www.mazayapost.com

Pinjol ilegal operates outside the regulatory framework, offering easy and quick loans with exorbitant interest rates and predatory lending practices. Victims of pinjol ilegal often find themselves trapped in a cycle of debt, leading to financial ruin, mental health problems, and even suicide.

Addressing pinjol ilegal requires a multifaceted approach. Strengthening regulation, increasing financial literacy, and fostering collaboration between law enforcement and financial institutions are crucial steps. By working together, we can protect consumers from the dangers of pinjol ilegal and promote a fair and inclusive financial system.

Conclusion

The fight against pinjol ilegal is an ongoing battle, but it is one that we must win. By understanding the causes and consequences of this predatory practice, we can develop effective measures to protect consumers and ensure a fair and equitable financial system.

The key to success lies in collaboration. Lawmakers, regulators, financial institutions, and consumer advocates must work together to create a comprehensive and effective regulatory framework. Only through collective action can we prevent pinjol ilegal from continuing to wreak havoc on the lives of Indonesians.