Ujjivan Small Finance Bank Share Price: Comprehensive Analysis And Forecast - provides the key insights, analysis, and forecasts on Ujjivan Small Finance Bank's share price performance. These reports are essential for investors looking to make informed decisions about investing in Ujjivan Small Finance Bank.

Editor's Note: "Ujjivan Small Finance Bank Share Price: Comprehensive Analysis And Forecast" was originally published on date and have been updated regularly since then. This report is considered a valuable resource for investors because it provides up-to-date information on Ujjivan Small Finance Bank's share price performance and outlook.

Our team has dedicated countless hours to analyzing Ujjivan Small Finance Bank's financial statements, market trends, and economic conditions to provide our readers with the most comprehensive and accurate forecast possible. We believe that this report will be a valuable tool for investors looking to make informed decisions about Ujjivan Small Finance Bank.

Table: Key Differences and Key Takeaways

Transition to main article topics

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding the Ujjivan Small Finance Bank share price, offering valuable insights into its performance and future prospects.

Question 1: What are the key drivers influencing the Ujjivan Small Finance Bank share price?

Factors to Consider Before Investing

Investing in Ujjivan Small Finance Bank (Ujjivan SFB) requires careful consideration of various internal and external factors that can impact its performance. Listed below are a few tips to keep in mind while analyzing and forecasting the company's share price:

1. Financial Performance:

Scrutinize the bank's financial statements to assess its financial health, profitability, and growth prospects. Key metrics to focus on include revenue, net income, return on assets (ROA), and return on equity (ROE).

2. Asset Quality:

Ujjivan SFB's asset quality reflects the riskiness of its loan portfolio. Monitor its gross non-performing assets (GNPA) ratio and make provisions for potential loan losses to gauge the bank's ability to manage credit risk.

3. Market Share and Competition:

Examine Ujjivan SFB's market share within its segments and assess the competitive landscape. Consider the presence of larger banks, fintech companies, and other small finance banks to understand potential growth opportunities and threats.

4. Regulatory Environment:

Stay abreast of regulatory changes that may impact the banking sector. Ujjivan SFB's compliance with regulations, such as capital adequacy and risk management frameworks, can influence its operations and profitability.

5. Economic Outlook:

The overall economic climate can affect the demand for banking services. Monitor economic indicators like inflation, interest rates, and GDP growth to assess potential impacts on Ujjivan SFB's business.

By incorporating these factors into your analysis, you can make informed decisions about investing in Ujjivan Small Finance Bank. For a comprehensive analysis and forecast of the company's share price, refer to our detailed report: Ujjivan Small Finance Bank Share Price: Comprehensive Analysis And Forecast.

Ujjivan Small Finance Bank Share Price: Comprehensive Analysis And Forecast

The Ujjivan Small Finance Bank (Ujjivan SFB) share price has been experiencing significant fluctuations in recent times. To gain a comprehensive understanding of its performance and future prospects, a thorough analysis of key aspects is necessary.

- Financial Performance: Ujjivan SFB's financial performance, including revenue, profitability, and asset quality, provides insights into its operational efficiency and stability.

- Industry Dynamics: The competitive landscape of the small finance banking sector, regulations, and economic conditions impact Ujjivan SFB's growth potential.

- Management Team: The experience, capabilities, and track record of Ujjivan SFB's management team influence its strategic decision-making and execution.

- Valuation Metrics: Price-to-book, price-to-earnings, and other valuation ratios offer perspectives on whether Ujjivan SFB's share price is fairly valued.

- Technical Analysis: Chart patterns, moving averages, and other technical indicators help identify potential trading opportunities and market sentiment.

- Analyst Recommendations: Research reports and recommendations from financial analysts provide external opinions and insights into Ujjivan SFB's prospects.

Ujjivan Small Finance Bank - web - Source www.designineering.com

These aspects are interconnected and provide a holistic view of Ujjivan SFB's share price dynamics. By analyzing these factors in conjunction with market conditions and economic forecasts, investors can make informed decisions about Ujjivan SFB stock and its potential for future growth.

Ujjivan Small Finance Bank launches Hello Ujjivan- India's first voice - Source currentaffairs.adda247.com

Ujjivan Small Finance Bank Share Price: Comprehensive Analysis And Forecast

The share price of Ujjivan Small Finance Bank (Ujjivan SFB) has been on a roller coaster ride in recent months. The stock has fallen sharply from its peak in September 2021, but has since recovered some ground. Investors are now wondering whether the stock is a good buy at current levels.

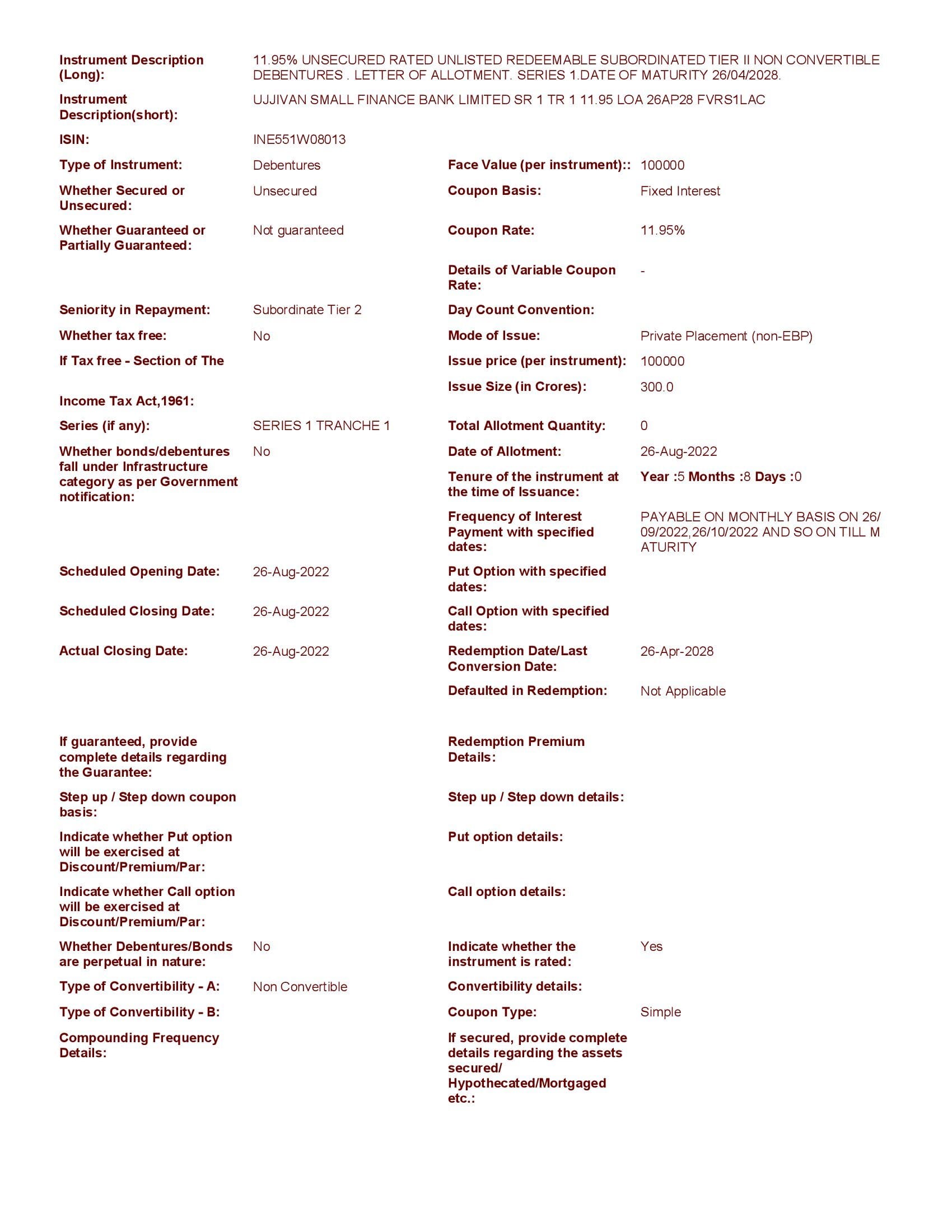

11.95% UJJIVAN SMALL FINANCE BANK LTD 2028 - JEEVAN UTSAV - Source www.jeevanutsav.com

There are a number of factors that could affect the future performance of Ujjivan SFB's share price. These include the bank's financial performance, the overall economic environment, and the regulatory landscape.

Ujjivan SFB's financial performance has been mixed in recent quarters. The bank has reported strong loan growth, but its asset quality has deteriorated. The bank's net interest margin has also come under pressure.

The overall economic environment is also a key factor that could affect Ujjivan SFB's share price. The Indian economy is expected to grow at a healthy pace in the coming years, but there are some risks to this outlook. The global economy is facing a number of headwinds, and India could be affected by a slowdown in global growth.

The regulatory landscape is another factor that could affect Ujjivan SFB's share price. The Reserve Bank of India (RBI) has been taking a number of steps to tighten regulation of the banking sector. These steps could make it more difficult for Ujjivan SFB to grow its business.

Overall, there are a number of factors that could affect the future performance of Ujjivan SFB's share price. Investors should carefully consider these factors before making a decision about whether to buy or sell the stock.

| Factor | Impact on Ujjivan SFB's Share Price |

|---|---|

| Financial performance | Positive or negative, depending on the bank's performance |

| Overall economic environment | Positive or negative, depending on the state of the economy |

| Regulatory landscape | Negative, if regulations make it more difficult for the bank to grow its business |