Understanding Interest Rates: Key Considerations for Financial Planning

Considerable confusion surrounds interest rates, a crucial factor in financial planning. Interest rates wield significant influence on investment returns, borrowing costs, and overall financial well-being. This guide will illuminate the complexities of interest rates, empowering financial decision-makers with the knowledge to navigate the complexities of the financial landscape.

Through meticulous analysis and thorough research, we have meticulously crafted this comprehensive guide to assist individuals in making informed financial decisions.

A tabular format outlines the key differences or takeaways for easy comprehension:

|:---|

Embark on a deep dive into the intricacies of interest rates, gaining an understanding of their impact on financial planning, and exploring strategies to optimize financial well-being.

FAQ

This section aims to clarify common uncertainties surrounding interest rates, ensuring a comprehensive understanding for informed financial decision-making.

Question 1: What is the relationship between interest rates and economic growth?

Interest rates play a crucial role in influencing economic growth. Lower interest rates tend to stimulate borrowing and investment, leading to increased economic activity. Conversely, higher interest rates can restrain spending and slow down growth.

Understanding the nuances of interest rates is essential for navigating financial landscapes. By staying informed, individuals can make well-rounded decisions, mitigate risks, and optimize their financial strategies.

Proceed to the following section for further insights into the significance of interest rates.

Will Interest Rates Fall In 2025 - Amalie Maitilde - Source amandahjklouella.pages.dev

Tips

Kara Kahn - Paramount Bank - Source paramountbank.com

Interest rates are a fundamental aspect of financial planning, Understanding Interest Rates: Key Considerations For Financial Planning as they impact various aspects of personal finance such as savings, investments, and borrowing.

Tip 1: Understand the Types of Interest Rates

There are various types of interest rates, such as fixed rates and variable rates. Fixed rates remain constant over a specific period, while variable rates fluctuate based on market conditions. Understanding the differences between these rates is crucial for making informed financial decisions.

Tip 2: Monitor Interest Rate Trends

Interest rates are dynamic and can change over time. Monitoring interest rate trends helps individuals anticipate potential changes that may affect their financial plans. Staying informed about economic indicators and central bank policies can provide insights into future interest rate movements.

Tip 3: Consider the Impact on Savings and Investments

Interest rates significantly influence the returns on savings and investments. Higher interest rates generally lead to higher returns on savings accounts and fixed income investments. However, they can also reduce returns on long-term bonds and other interest-rate sensitive investments.

Tip 4: Leverage Interest Rates for Borrowing

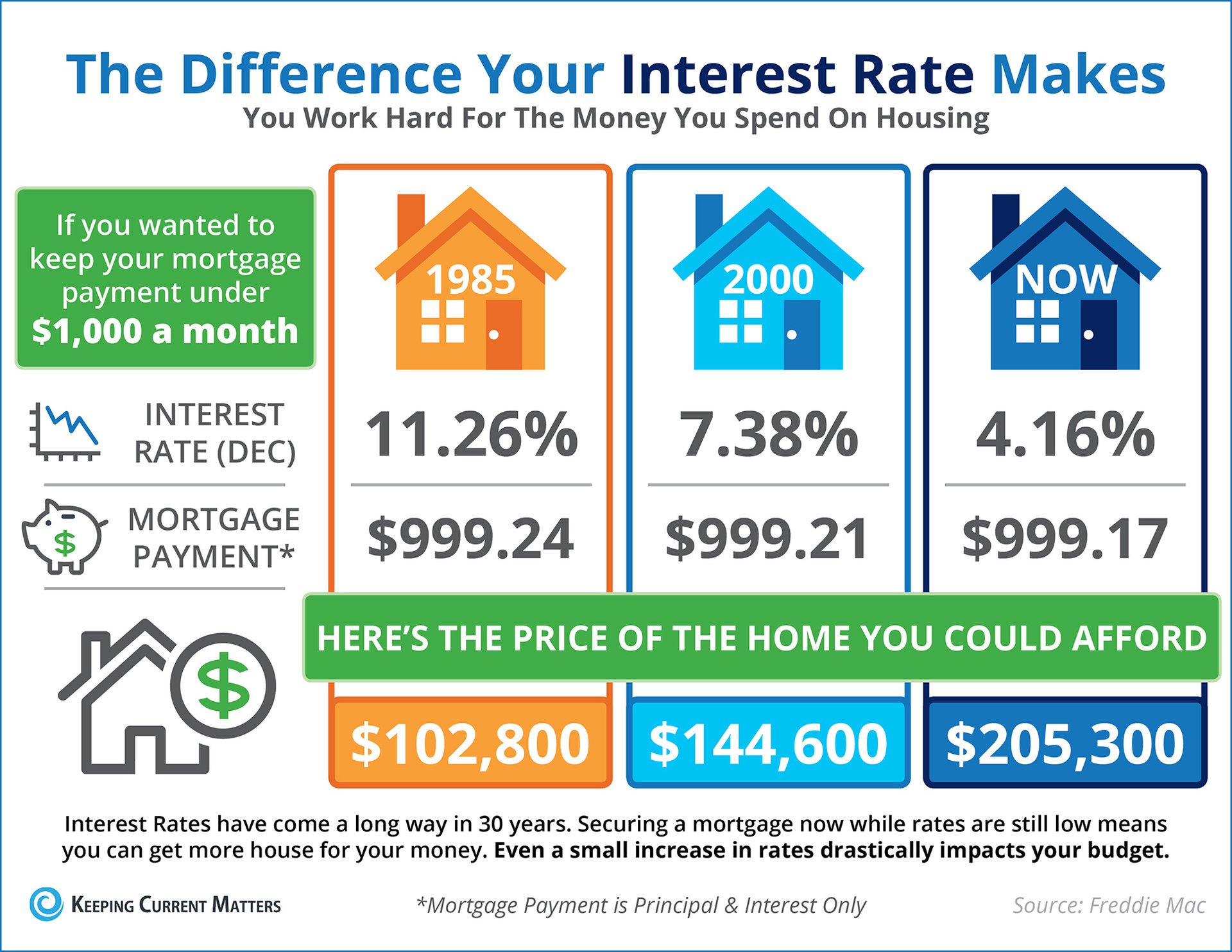

Interest rates determine the cost of borrowing. When interest rates are low, it can be advantageous to take out loans for major purchases or investments. Conversely, high interest rates may increase the cost of borrowing, making it more expensive to finance debt.

Tip 5: Manage Risks Associated with Interest Rate Fluctuations

Interest rate fluctuations can pose risks to financial plans. Utilizing instruments like interest rate swaps or adjustable-rate mortgages can help manage these risks and protect against potential adverse effects.

By following these tips, individuals can gain a deeper understanding of interest rates and make informed financial decisions. Remember, understanding interest rates is a key consideration for successful financial planning and long-term financial well-being.

Understanding Interest Rates: Key Considerations For Financial Planning

Interest rates play a pivotal role in financial planning and decision-making. Understanding their impact is crucial for individuals seeking to manage their finances effectively.

- Impact on Investments: Higher interest rates can enhance the returns on fixed-income investments like bonds.

- Borrowing Costs: Rising interest rates lead to higher costs of borrowing, such as for mortgages and personal loans.

- Inflation Higher interest rates aim to curb inflation by reducing demand for goods and services.

- Economic Growth: Interest rates can influence economic growth, as higher rates may slow down business investments.

- Central Bank Policy: Central banks adjust interest rates to manage inflation and stimulate economic activity.

- Personal Finances: Individuals need to consider the impact of interest rates on their savings, debt repayment, and financial goals.

Understanding these key aspects empowers individuals to make informed financial decisions, plan for the future, and mitigate the potential risks and rewards associated with changing interest rates. For instance, when interest rates are high, it may be prudent to allocate a larger portion of assets to fixed-income investments. Conversely, during periods of low interest rates, exploring alternative investment options may be more beneficial.

Interest Rates In 2025 Mortgage Images References : - Amira Ryder - Source amiraryder.pages.dev

Understanding Interest Rates: Key Considerations For Financial Planning

Understanding interest rates is a crucial aspect of financial planning. Interest rates have a far-reaching impact on various financial decisions, such as borrowing, saving, and investing. A thorough comprehension of interest rates empowers individuals to make informed financial choices and plan for their future.

Ch06 Understanding Interest Rates Determinants and Movements - CHAPTER - Source www.studocu.com

Interest rates influence the cost of borrowing. Higher interest rates lead to higher interest payments on loans, making it more expensive to finance purchases or investments. Conversely, lower interest rates make borrowing more affordable, stimulating economic growth and consumer spending.

Understanding interest rates is also essential for savers. When interest rates are high, savings accounts and other fixed-income investments offer higher returns. This encourages saving and helps individuals accumulate wealth over time. However, when interest rates are low, returns on savings are diminished, making it more challenging to reach financial goals.

Furthermore, interest rates impact investment decisions. Rising interest rates generally lead to a decline in bond prices, as investors seek higher returns. Conversely, falling interest rates boost bond prices. Understanding the relationship between interest rates and investment performance enables investors to make strategic portfolio adjustments.

In conclusion, interest rates play a pivotal role in financial planning. By understanding the impact of interest rates on borrowing, saving, and investing, individuals can make informed financial decisions to achieve their long-term goals.

| Interest Rate Environment | Impact on Borrowing | Impact on Saving | Impact on Investing |

|---|---|---|---|

| High Interest Rates | Increased borrowing costs | Higher returns on savings | Declining bond prices |

| Low Interest Rates | Reduced borrowing costs | Diminished returns on savings | Rising bond prices |