United India Insurance: Comprehensive Coverage For Your Assets And Security

Are you seeking a comprehensive insurance solution that safeguards your assets and provides peace of mind? United India Insurance offers a comprehensive suite of insurance policies that cater to your diverse insurance needs. With United India Insurance, you can rest assured that your assets are protected against unforeseen events and secure your financial future.

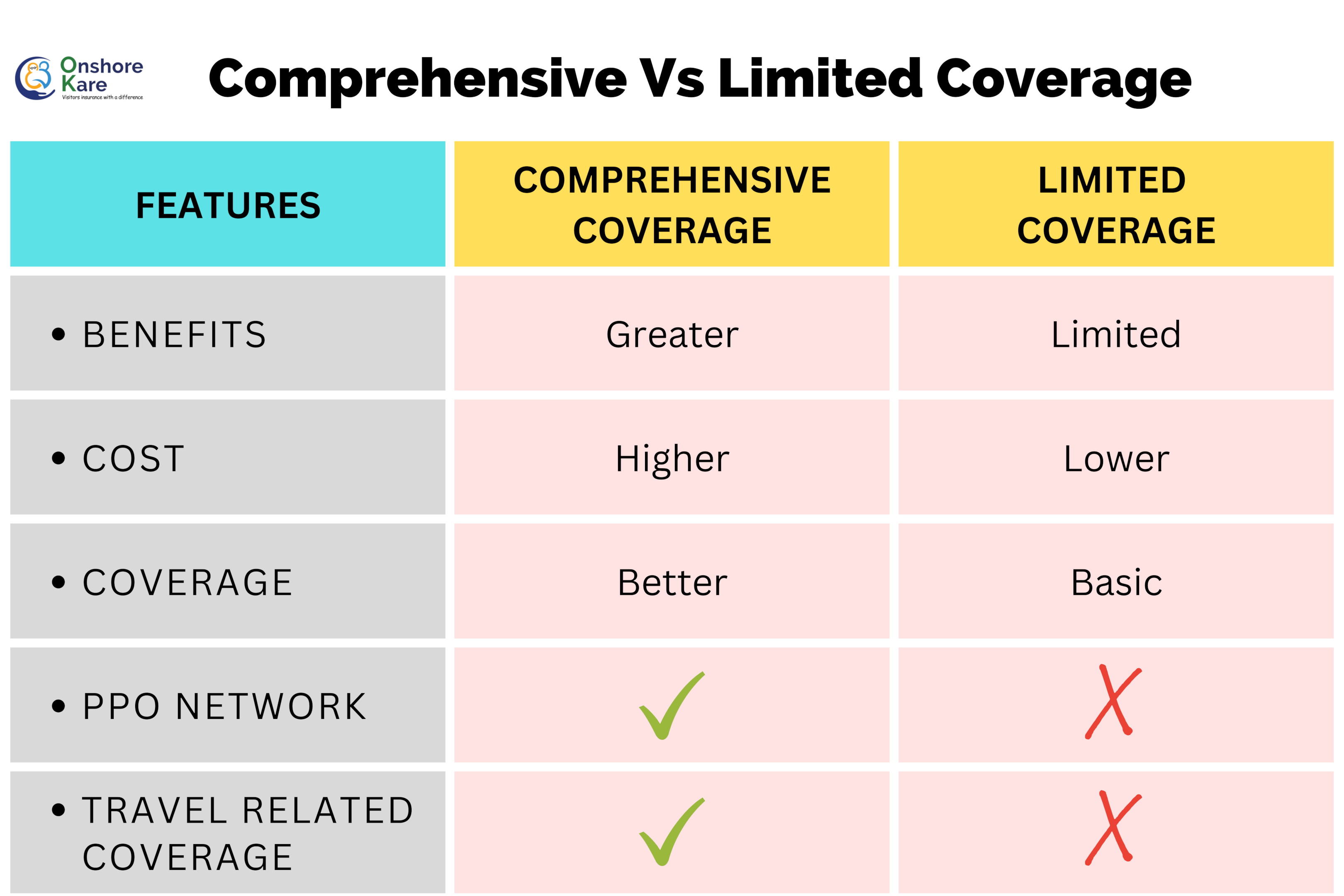

Comprehensive Medical Insurance for Travel - OnShoreKare - Source onshorekare.com

Editor's Notes:

United India Insurance: Comprehensive Coverage For Your Assets And Security Published on [Date], provides an in-depth understanding of the benefits and importance of this insurance for individuals and businesses. Our team has conducted extensive research and analysis to present this comprehensive guide, empowering readers to make informed decisions regarding their insurance needs.

Through this United India Insurance: Comprehensive Coverage For Your Assets And Security guide, we aim to highlight the key benefits and features of these insurance policies. Whether you're an individual seeking to protect your personal assets or a business owner safeguarding your operations, this guide will provide valuable insights and help you choose the right insurance solution for your specific requirements.

The table below provides a summary of the key takeaways from this guide:

| Key Differences | United India Insurance: Comprehensive Coverage For Your Assets And Security |

|---|---|

| Comprehensive Coverage | Provides comprehensive coverage for a wide range of assets, including property, vehicles, and personal belongings |

| Financial Security | Offers financial protection against losses or damages caused by unforeseen events, ensuring your financial stability |

| Peace of Mind | Provides peace of mind knowing that your assets are protected, allowing you to focus on other aspects of your life or business |

| Customized Solutions | Tailors insurance policies to specific needs, providing customized coverage that meets your unique requirements |

| Expert Support | Provides access to a team of experienced insurance professionals who offer guidance and support throughout the insurance process |

In the following sections, we will delve deeper into the various aspects of United India Insurance: Comprehensive Coverage For Your Assets And Security, exploring its benefits, features, and how it can provide you with the protection and peace of mind you need.

FAQ

Embark on a comprehensive exploration of the most frequently asked questions regarding United India Insurance's extensive coverage plans tailored to safeguard your assets and ensure your peace of mind.

Question 1: What types of assets can be protected under the comprehensive coverage offered by United India Insurance?

United India Insurance's comprehensive coverage extends to a diverse range of assets, including residential and commercial properties, vehicles, valuable possessions, and even businesses. This all-encompassing protection ensures that your physical and financial assets are shielded against unforeseen events.

Question 2: What are the perils covered under the comprehensive insurance policies?

The comprehensive coverage policies from United India Insurance provide protection against a wide spectrum of perils, including fire, theft, natural calamities, accidental damage, and malicious acts. By mitigating these risks, our policies empower you to safeguard your assets and financial well-being.

Question 3: What are the benefits of opting for comprehensive coverage over basic insurance policies?

Comprehensive coverage offers a superior level of protection compared to basic insurance policies by extending coverage to a broader range of perils and providing higher compensation limits. Choosing comprehensive coverage ensures that your assets receive the maximum protection they deserve.

Question 4: What factors influence the premium amount for comprehensive insurance policies?

The premium amount for comprehensive insurance policies is determined based on various factors, such as the type and value of the asset being insured, the location of the property, and the level of coverage required. By carefully assessing these factors, United India Insurance tailors the premium to suit your specific needs and budget.

Question 5: How does the claim settlement process work under comprehensive insurance policies?

United India Insurance's streamlined claim settlement process ensures a hassle-free experience. In the event of a covered loss, policyholders can promptly register their claims through our dedicated channels. Our team of experts will swiftly evaluate the claim and guide you through the settlement process, providing timely compensation to facilitate a swift recovery.

Question 6: What additional benefits are available under comprehensive insurance policies?

In addition to the core coverage, United India Insurance's comprehensive policies offer a range of value-added benefits, including 24/7 roadside assistance, emergency home repairs, and premium discounts for safety features. These benefits go beyond mere insurance, providing enhanced convenience and peace of mind.

Summary: By choosing comprehensive coverage from United India Insurance, you invest in the protection and security of your assets. Our policies are meticulously designed to safeguard your valuable possessions against a multitude of perils, ensuring that you can navigate unexpected events with confidence.

To explore further insights and delve deeper into the intricacies of comprehensive insurance, we invite you to continue your exploration through our comprehensive knowledge base.

Tips by United India Insurance: Comprehensive Coverage For Your Assets And Security to Enhance Your Insurance Strategy

In today's complex and ever-changing risk landscape, protecting one's assets and ensuring financial stability is paramount. A comprehensive insurance coverage serves as a vital safeguard against unforeseen events that can threaten financial well-being. United India Insurance offers a range of insurance products designed to provide individuals and businesses with tailored solutions to meet their specific needs. By incorporating the following tips into one's insurance strategy, individuals can maximize coverage, minimize risks, and ensure peace of mind:

Tip 1: Conduct a Thorough Risk Assessment

A comprehensive risk assessment is crucial to identify potential vulnerabilities and determine the appropriate level of insurance coverage. This involves evaluating assets, liabilities, and exposure to various risks. By conducting a thorough assessment, individuals can prioritize their insurance needs and avoid underinsurance.

Tip 2: Choose the Right Insurance Policies

United India Insurance offers a wide range of insurance policies designed to address specific risks. These include property insurance, liability insurance, health insurance, and business insurance. It is important to carefully evaluate the coverage provided by each policy and select those that align with one's specific requirements.

Tip 3: Increase Coverage Limits and Reduce Deductibles

Adjusting coverage limits and deductibles can significantly impact the level of financial protection provided by insurance. Increasing coverage limits ensures adequate coverage for valuable assets or potential liabilities. Conversely, lowering deductibles reduces out-of-pocket expenses in the event of a claim. However, it is essential to balance coverage limits and deductibles with affordability.

Tip 4: Review and Update Insurance Regularly

Insurance needs change over time as assets, liabilities, and risk exposures evolve. It is essential to review and update insurance coverage regularly to ensure it remains adequate. This involves assessing changes in property value, business operations, and personal circumstances.

Tip 5: Bundle Insurance Policies

Bundling multiple insurance policies with the same carrier can often lead to cost savings and streamline insurance management. United India Insurance offers package policies that combine different types of coverage, such as property and liability insurance, into a single comprehensive policy. Bundling can provide convenience and potential discounts.

Tip 6: Consider Additional Coverage Options

While standard insurance policies provide a solid foundation for protection, additional coverage options can enhance protection against specific risks. These may include riders or endorsements that cover valuables, equipment breakdown, or business interruption. Evaluating these options can provide tailored coverage for unique needs.

Summary:

By implementing these tips, individuals and businesses can enhance their insurance coverage, minimize risks, and safeguard their financial well-being. It is imperative to remember that insurance is not merely a cost but an investment in protecting one's assets and ensuring financial stability. By tailoring insurance strategies to specific needs and incorporating the recommendations outlined above, individuals can maximize the benefits of insurance and achieve peace of mind.

United India Insurance: Comprehensive Coverage For Your Assets And Security

In the ever-changing landscape of today's world, safeguarding your valuable assets and ensuring your financial security is paramount. With United India Insurance, you can rest assured that your assets are comprehensively protected, giving you peace of mind and the confidence to navigate life's uncertainties.

- Comprehensive Coverage: United India Insurance offers a wide range of policies tailored to cover diverse assets, ensuring that your valuable possessions are protected against unforeseen events.

- Tailor-made Solutions: Their plans are customizable to meet your specific needs, providing you with tailored coverage that aligns with your risk profile.

- Expert Guidance: United India Insurance's knowledgeable professionals provide expert advice and guidance, helping you make informed decisions about your insurance coverage.

- Reliable Claims Settlement: Known for their prompt and efficient claims settlement process, you can count on United India Insurance to be there for you when you need them most.

- Financial Security: Their strong financial standing ensures that your claims will be honored, providing you with financial stability and peace of mind.

- Nationwide Network: With a vast network of offices and agents across the country, United India Insurance ensures that you have access to their services wherever you may be.

For instance, their Home Insurance policy not only protects your property from damage or theft but also provides coverage for your valuables, giving you comprehensive protection for your home and belongings. Similarly, their Health Insurance plans offer a range of options to cater to your healthcare needs, ensuring that you and your family have access to quality medical care. United India Insurance's commitment to comprehensive coverage and financial security makes them a trusted choice for safeguarding your assets and ensuring your peace of mind.

DeFi insurance: Why buy coverage for your digital assets? - Source forkast.news

United India Insurance: Comprehensive Coverage For Your Assets And Security

United India Insurance offers comprehensive coverage for assets and security, providing financial protection against various risks and uncertainties. This coverage is essential for individuals and businesses to safeguard their valuable assets and ensure financial stability in the event of unexpected events.

Word Writing Text Car Insurance. Business Concept for Accidents - Source www.dreamstime.com

The importance of United India Insurance's comprehensive coverage lies in its ability to mitigate financial losses arising from unforeseen circumstances. By providing coverage for property damage, theft, accidents, natural disasters, and other perils, individuals and businesses can protect their financial interests and minimize the impact of potential risks.

For instance, a comprehensive insurance policy from United India Insurance can cover the cost of repairs or replacement in case of fire or theft, providing peace of mind and ensuring that financial resources are not depleted in the face of adversity. Moreover, the coverage extends to liability protection, safeguarding policyholders from legal claims and financial obligations resulting from accidents or incidents involving their assets.

Conclusion

United India Insurance's comprehensive coverage is a vital component of asset and security management, offering individuals and businesses the necessary protection against unforeseen events. By understanding the connection between comprehensive coverage and financial security, policyholders can make informed decisions to safeguard their assets and ensure their financial well-being.

The comprehensive coverage provided by United India Insurance empowers policyholders to mitigate risks, reduce financial vulnerabilities, and maintain stability in the face of uncertainties. It is a testament to the company's commitment to providing comprehensive solutions that protect the interests of its customers.